Understanding the Fundamentals of Finance

Gaining a grasp of finance involves exploring core principles, key financial markets, and various finance types. This knowledge applies to personal finance, corporate finance, and other financial sectors.

Finance and Accounting Principles

Grasping finance starts with key accounting principles. You’ll focus on understanding financial statements—balance sheets, income statements, and cash flow statements. They reveal an organization's health and financial flows.

Learn budgeting techniques to manage expenses effectively. This insight guides investments and financial management decisions. Master concepts like assets, liabilities, and equity for informed decision-making. These elements help maintain a clear financial picture.

Major Financial Markets

Financial markets play a crucial role in capital allocation and economic stability. The stock market, for example, facilitates investments, offering access to equity for growth. Understanding how transactions are performed and securities traded is essential.

The bond market, another vital part, deals in debt securities. It’s a channel for corporate and government financing. Gaining insights here helps you understand interest rates and yields, influencing strategic financial planning.

Types of Finance

Exploring various finance types opens up different avenues and opportunities. Personal finance focuses on budgeting, savings, and investments for individual needs. It involves managing income, expenses, and planning for future goals.

Corporate finance concerns business operations, emphasizing capital structuring, investment funding, and financial planning. This area covers mergers, acquisitions, and risk management.

Public finance deals with government revenue and expenditure. Understanding these finance types provides a comprehensive view, enabling you to navigate financial landscapes effectively.

Education and Degree Programs in Finance

Finance education offers a variety of pathways, from undergraduate degrees to specialized graduate programs. With flexible online platforms, you can tailor your learning experience to fit your career goals. Here's a look at key elements to consider in finance education.

Choosing the Right Finance Degree

Selecting the right finance degree depends on your career aspirations and current qualifications. If you have a high school diploma and are interested in finance, an undergraduate program is a logical next step. You will want to attend a high-quality program since finance majors need strong skills in analytics, communication and forecasting. With a strong educational program and experience, these skills can be developed over time.

Undergraduate Degrees in Finance

Undergraduate degrees offer a comprehensive foundation in finance. Most associate degree finance programs will require around 60 credit hours and cover most of your prerequisite courses and some finance courses. Most bachelor’s degree programs require around 120 credits and cover fundamental topics such as financial management, accounting, and economics. You should expect coursework focused on technical and analytical skills. An accelerated degree in finance is the same amount of credit hours, but you are able to finish your degree program in less time. Pursuing a Bachelor's in Finance or a related field can prepare you for roles in financial analysis, banking, or accounting with median annual salaries around $79,050 according to BLS.

Courses in financial analysis teach us how to evaluate companies' financial health, interpret financial statements, and forecast future performance. These degrees often incorporate hands-on learning through case studies and projects that mimic real-world financial scenarios. Internships, which many programs require, offer practical experience that is invaluable for entering the finance industry. Students who complete these degrees will be well-prepared for roles such as financial analyst, investment banker, or in corporate finance.

Graduate Degrees in Finance

For those seeking advanced knowledge, graduate degrees can be pivotal. Options include a Master of Finance or an MBA in finance, each offering different specializations like investment banking or financial planning. These programs often incorporate more complex topics and require work experience. They can lead to executive roles or specialized positions with anticipated job growth as high as 20% in some areas.

Advanced degrees often emphasize case-based learning and may include courses on emerging topics like ESG (Environmental, Social, and Governance) investing. We typically engage in strategic simulations, providing insights into financial decision-making at higher organizational levels. Graduates of advanced programs frequently occupy senior roles or leadership positions, such as portfolio manager or CFO, and often experience expanded career opportunities thanks to their specialized knowledge and skills.

Online Platforms Offering Finance Education

Online universities and colleges offer flexible and accessible ways to advance your finance education. These platforms provide courses ranging from introductory to advanced levels. Options include specialized certificates and degree programs designed for working professionals. Most online programs allow you to learn at your own pace, integrating education into your life seamlessly.

Navigating Finance Certifications and Licensure

In the finance industry, obtaining finance certifications and licensure can enhance your career opportunities and credibility. Understanding the certifications available and the requirements for state and federal licensure can guide you in advancing your professional development.

Certifications for Finance Specialists

Certifications in finance provide recognition for expertise in areas like investment analysis, risk management, and financial planning. Popular certifications include the Chartered Financial Analyst (CFA), Certified Public Accountant (CPA), and Certified Financial Planner (CFP). Each certification typically requires passing a rigorous exam and meeting educational prerequisites.

For example, to become a CFA, you need to pass a three-part exam and possess a bachelor's degree. A CPA credential is essential for accountants and auditors, often involving a state-specific exam. Certifications not only demonstrate your proficiency but also enhance your ability to manage compliance and risk within financial operations.

State and Federal Licensure Requirements

Licensure is crucial for certain financial professions, such as accountants, auditors, and financial examiners. Each state may have different requirements for licensure, often including an educational background, experience, and passing scores on certification exams. Budget analysts and credit analysts may not always require a license, but it can be advantageous for career advancement.

Federal licensure requirements may also apply when dealing with specific financial products or services. Understanding what is required for your role ensures lawful practice and upholds industry standards. Always check the specific licensure requirements based on your location and field of specialization to stay compliant with regulations.

Career Pathways in Finance

Exploring career pathways in finance can lead you through a range of opportunities across different levels of expertise. Starting in entry-level roles, you develop core skills; as you progress to mid-level roles, you assume more responsibility and specialize; finally, senior-level roles require strategic thinking and leadership abilities.

Entry-Level Finance Careers

Starting your journey in finance often involves roles like financial analyst, accountant, or auditor. These positions provide foundational knowledge and skills in financial analysis, reporting, and compliance. Financial analysts evaluate financial data to help guide investment decisions. Accountants focus on preparing and examining financial records, ensuring their accuracy. Auditors inspect financial statements for compliance, offering an essential check on a company's financial health.

In these roles, gaining certifications such as CPA or CFA adds value to your skills. Working in sectors like investment banking, commercial banking, or real estate can offer various paths to follow. These experiences will help you build expertise necessary for advancement to higher responsibilities.

Mid-Level Finance Professionals

As you progress, roles like portfolio manager or finance manager might become available. These positions require strong analytical skills, decision-making abilities, and specialization in areas like asset management or financial planning. Portfolio managers oversee investment portfolios, implementing strategies to maximize returns while managing risk.

In finance management, you may handle budgets, financial forecasting, and team leadership. You begin focusing on bigger-picture financial strategies rather than just number crunching. Certifications and further educational pursuits enhance career movement. Networking and professional associations provide opportunities to further expand your career in financial services.

Senior-Level Financial Roles

Senior roles such as finance director or chief financial officer (CFO) demand comprehensive understanding and strategic oversight of an organization’s financial activities. In these positions, you develop and implement financial strategies to enhance company growth and stakeholder value.

Experience in various financial sectors, like real estate or investment banking, strengthens your expertise. Leadership skills, combined with a track record of successful decision-making, are crucial. Actuaries in senior positions assess financial risks using math, statistics, and financial theory to aid in decision-making. Continuously evolving in these careers involves keeping up with industry changes and fostering adaptability.

Essential Finance Skills and Technologies

In the evolving world of finance, honing a mix of technical and soft skills is essential. Advanced mathematical proficiency, technological savvy, and crucial interpersonal skills form the core of a successful finance professional's toolkit.

Advanced Mathematical Proficiency

Strong mathematical skills are indispensable in finance. These are essential for data analysis, financial modeling, and financial analysis. A firm grasp of statistics, algebra, and calculus helps you interpret financial data and make informed forecasts.

Proficiency in Excel and financial software applications assists in performing complex calculations efficiently. Financial analysts and accountants rely on these skills to assess financial health and predict future trends.

Advanced mathematics enables professionals to create intricate models illustrating potential investments or liabilities.

Technological Savvy in Finance

Technology plays a pivotal role in modern finance. Being adept with financial technologies (fintech) is critical. Using tools like Python for programming, data analytics software, and blockchain for secure transactions allows you to streamline operations and enhance efficiency.

Understanding fintech innovations can significantly boost your capabilities as a financial expert or auditor. Tools that automate tasks and provide insights through big data are particularly valuable.

Tech-savvy professionals can foresee market changes. They adapt quickly to evolving technologies to gain a competitive edge.

Essential Soft Skills in Finance

Soft skills complement technical expertise. Effective communication is crucial for articulating complex financial concepts clearly, both verbally and in writing. This ensures your colleagues and clients understand your analyses and recommendations.

Problem-solving and critical thinking are vital for dealing with unexpected financial challenges and strategizing accordingly. Adaptability helps you thrive amidst ever-changing financial regulations and market dynamics.

Leadership skills are also important. They empower you to manage teams and projects efficiently. Interpersonal skills foster strong client relationships and collaboration within teams.

Developing these skills is key to advancing your finance career.

Finance Industry Jobs and Employment Outlook

Finance careers, such as those of financial analysts, accountants, and loan officers, are expanding due to technological advancements and a growing economy. From hiring trends to interview preparation, understanding the finance job landscape can boost your chances of success.

Current Trends in Finance Employment

The finance industry is experiencing significant demand, particularly in roles related to financial analysis and management. Financial analysts' employment is expected to grow much faster than the average for all occupations. About 30,700 openings for financial analysts are projected annually. Moreover, the business services industry, which includes banking and accounting roles, accounted for over 40% of finance jobs in early 2024. This rising demand is driven by the evolving economic landscape and the increased complexity of financial regulations.

Banks and financial institutions are actively searching for skilled professionals to manage investment portfolios and capitalize on emerging market trends. Additionally, you may find opportunities in compliance and risk management roles as regulations continue to tighten.

Preparing for a Finance Job Interview

Preparing for a finance job interview requires a thorough comprehension of industry specifics and your role. You should highlight any relevant finance degrees, certifications, and practical experiences. For roles like accountants or auditors, demonstrating your knowledge of financial regulations and analytical skills may set you apart from other candidates.

Behavioral questions often arise, so practice responses that showcase your problem-solving and decision-making abilities. It is beneficial to stay updated on current trends by reading industry publications and analyzing recent financial headlines.

For roles in loan offices or banks, understanding customer service dynamics and lending policies can be crucial. Tailor your interview preparation to reflect the specific job opportunities and career options you're pursuing.

Resources for Continued Financial Education

For those looking to deepen their understanding of finance, numerous resources are available. From prestigious publications to engaging webinars, these tools can enhance your financial literacy and advance your career in finance.

Publications and Journals in Finance

Incorporating publications and journals into your study routine is essential. Notable examples include The Wall Street Journal and The Economist, which provide in-depth analysis and insights into global financial trends. These publications can offer you a comprehensive understanding of market dynamics, policy changes, and economic forecasts. Subscribing to relevant finance journals can also keep you updated on the latest research and developments in the field. Furthermore, many finance-focused magazines and newsletters answer frequently asked questions about current financial issues, enriching your learning experience.

Conferences and Networking in Finance

Attending finance conferences can significantly broaden your perspective. These events offer excellent opportunities for networking with industry leaders and staying updated on cutting-edge finance technologies and methodologies. By participating, you can exchange ideas, gain insights from keynote speakers, and build valuable professional connections. Conferences often include workshops and panel discussions, where you can dive deep into specialized topics. Additionally, networking at such events can open doors for collaborative projects, mentorship opportunities, and career advancements.

Online Learning and Finance Webinars

Online learning platforms provide accessible resources to enhance your financial expertise. Webinars and courses offer flexible learning experiences tailored to your schedule. Kaplan Financial Education, for instance, provides live, online, and self-study programs aimed at various professional levels. These online offerings often cover a wide range of subjects, from basic financial principles to advanced investment strategies. Podcasts and webinars frequently feature industry experts discussing market trends and investment tips, allowing you to learn from the comfort of your home. Engaging with these resources can significantly boost your financial competence and keep you informed about industry innovations.

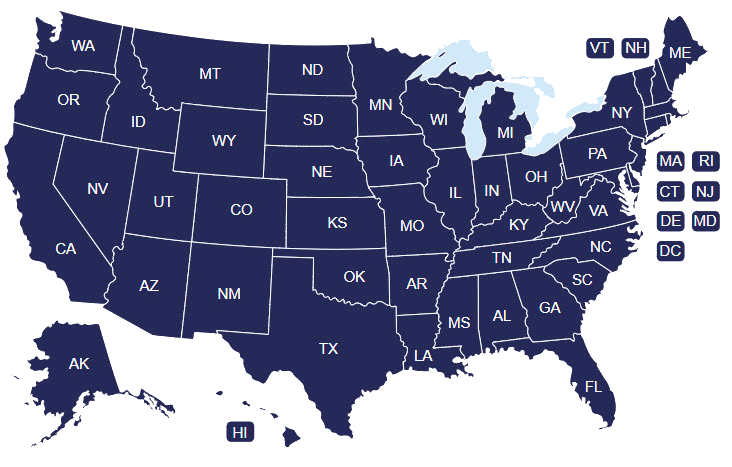

State-By-State Finance College Rankings

Select a State to Search Colleges & Universities

- Select a State

-

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- District of Columbia

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming