University Headquarters (HQ) is an industry-leading, independent educational organization that provides independent college rankings using a proprietary formula to create first class, unbiased rankings. The team at University HQ strives to provide accurate and trustworthy rankings that highlight the best programs for economics.

Are you considering a career as an economist? If you are interested in studying the production and distribution of resources, goods, and services and make your way to the top of the business world, this profession may be a good fit for you. The most successful professionals in this field are able to collect and analyze data, research trends, and evaluate economic issues. They also tend to have strong speaking, writing, critical-thinking, and analytical skills. Consider the following information if you wish to become an economist.

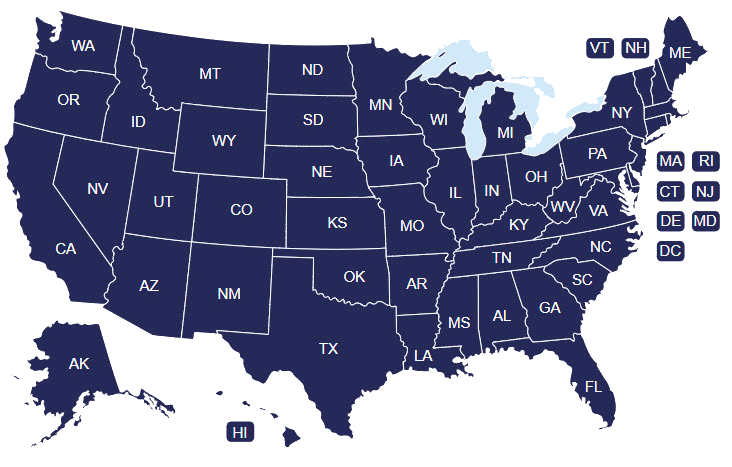

State-By-State Economics College Rankings

Select a State to Search Colleges & Universities

- Select a State

-

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- District of Columbia

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

Featured Economics Programs

Steps to Become an Economist

-

Step 1: Complete the Necessary Education Requirements

-

Step 2: Gain Work Experience and Hone Related Skills

-

Step 3: Join Professional Societies and/or Organizations

-

Step 4: Achieve Certification

Step 1: Complete the Necessary Education Requirements

Economists generally begin their academic careers with a bachelor’s in economics. Students can choose from a variety of fields as long as the program provides a strong foundation in mathematics. Most bachelor programs consist of 120 credit hours and can be completed by full-time students within four years.

In addition to a bachelor’s degree, economists also need a master’s degree in economics or PhD in economics to be successful in the field. Most master’s programs consist of 60 credit hours and require approximately two years to complete. PhD programs vary considerably, but generally span four to seven years depending on how long it takes to conduct your original research and finish a dissertation. In both cases, courses that focus on statistical economic software are particularly beneficial.

Many larger businesses, research institutes, and international organizations give preference to candidates with a combination of graduate education and work experience. Finding entry-level employment after graduation may be necessary in order to qualify for more elevated positions in the future.

Find Your Online Economics Program

Step 2: Gain Work Experience and Hone Related Skills

Prospective economists often need some sort of work experience to qualify for the most competitive and lucrative positions in the field. While entry-level opportunities for bachelor’s degree graduates do exist, it’s rare to find employment as an economist with this level of education. As a result, one of the best ways to gain valuable work experience early on is to find paid or unpaid internships.

Internship applicants may have to meet a number of qualifications prior to being selected. Some of the most common expectations include:

- Enrollment in an undergraduate or graduate program

- Understanding of Python, R, and other data visualization software

Internships allow students to work alongside full-time employees, providing highly valuable hands-on experience that can be applied to later education and employment. After further development and professional experience is gained through employment, it’s still important to continue honing important skills in communication, information technology (IT), numeracy, organization, and time management. Salaries tend to rise with each year of experience earned.

Step 3: Join Professional Associations

It is advisable for economists to join professional associations and/or organizations. There are several options available, and each offers a wide variety of benefits to both current practitioners and students.

Membership costs and benefits can vary significantly, making it essential to research all prospective associations and organizations thoroughly. Some of the most common reasons for joining include easy and unlimited access to economics-related tools and resources, conferencing and networking opportunities, free or discounted continued education courses, and a safe place to share ideas.

Popular economics organizations and associations include:

- American Economic Association (AEA)

- National Economic Association (NEA)

- World Economics Association (WEA)

- National Association for Business Economics (NABE)

- Society for the Advancement of Economics Theory (SAET)

Step 4: Achieve Certification

There are also numerous certifications available for economics professionals to pursue. While none are necessarily required, most can be extremely beneficial and may help candidates stand out among their competition.

Some of the most commonly sought-after options include:

- Certified Business Economist (CBE)

- Certified Economic Developer (CEcD)

- Chartered Economist (Ch.E.)

- Economic Development Finance Professional (EDFP)

The Certified Business Economist (CBE) credential is offered through the National Association of Business Economics (NABE). Applicants must have at least a bachelor’s degree, as well as two years of professional experience and membership with NABE, to qualify. The corresponding examination is multiple-choice and covers economics, statistics, data economic analysis, economic measurement, managerial decision making, macroeconomics, and microeconomics.

What is an Economist?

Economists study the relationship between societal resources and their production and/or output. They may focus on small communities or entire nations, as well as the global economy. The opinions and research data provided by economists is highly valuable, and it is often used to shape company and/or organizational policies. These professionals are instrumental in helping the government and privately-owned businesses react appropriately to economic issues.

Find Online Economics Schools

What Does an Economist Do?

Economists are responsible for advising businesses and/or organizations regarding various aspects of economics. These professionals regularly conduct surveys, collect data, and analyze findings using mathematical models, statistical techniques, and software. It’s also their job to present all relevant results to stakeholders. As a result, they must be proficient with the creation of reports, tables, and charts. Additionally, economists often interpret and forecast market trends, advise their employers on a number of economic topics, and recommend solutions to potential economic problems. It is also common for professionals in this field to write articles for academic journals, as well as other media outlets.

Most economists work independently in office settings, although collaboration with other economists and statisticians is sometimes necessary. It’s not uncommon for these professionals to work from home, while others may have to travel as part of their jobs. Work schedules can vary, but the majority of economists work full time. Some positions do require overtime. Many professionals in this field also offer consultation services to other businesses and organizations part-time.

Skills to Acquire

Those who plan to become an economist must realize that the field can be demanding. To ensure success, prospective professionals should begin developing and honing certain key skills as early as possible.

Most economists possess the following qualities:

- Analytical skills necessary to review data in detail, observe patterns, perform advanced calculations, and draw logical conclusions

- Critical-thinking skills necessary to use logic and reasoning to solve complex problems

- Communication skills necessary to explain data findings and survey results in ways that business and organization stakeholders can easily understand

- Interpersonal skills necessary to work with other analysts, researchers, and specialists, as well as with clients

- Writing skills necessary to present finding clearly in reports for colleagues and/or clients

- Problem-solving skills necessary to conduct and assist with research

- Technology skills necessary to utilize statistical economic analysis software appropriately

Economist Career & Salary

According to PayScale, the average base salary for economists is around $78,400 per year. According to data provided by the Bureau of Labor Statistics (BLS), the median annual wage for economists was $115,730 in 2023. This is above the median annual wage of $53,490 for all occupations. However, entry-level professionals might make closer to $63,000 per year. Salaries tend to rise with experience; professionals with the most experience int he highest-paid roles earn closer to $215,000 per year.

Search Programs Offering Economics Majors

Where Might You Work?

Economists often work for the federal government, state government, scientific research and development businesses, consulting service providers, and finance and insurance companies. The number one employer for this field in 2023 was the federal government, excluding postal services. States with the highest employment level for economists include DC, California, Virginia, Maryland, and Texas.

It’s important to note that high employment rates do not necessarily coincide with high salary potential. In 2020, DC was the top paying state for economists, followed by Virginia, Massachusetts, Maryland, and California.

Career Outlook

The job outlook for economists is promising. The Bureau of Labor Statistics projects there will be a 5% increase in job availability between 2023 and 2033. This is much lower than it was just four years ago, but it's also about even with the average for all other occupations. Most of the new positions created are likely to be with firms that specialize in research and consulting services.

The major reason for this increase is that many industries depend on economic analysis and quantitative methods to study and forecast business, sales, and other important market trends. As more and more organizations look to economists to analyze pricing, advertising, and other data-driven facets, it may become easier to find employment. Additionally, highly qualified professionals in the field will be in high demand as the global economy continues to become more complex and competitive.

Individuals with master’s degrees will have the best job prospects, especially those who have experience using statistical economic analysis software. Professionals with only a bachelor’s degree may struggle to find work, however, and may be forced to explore other career options.

Advancing from Here

A doctoral degree may or may not be required for jobs in economics, but earning one is the best way to access top employment opportunities within the field. This level of education is particularly important for individuals interested in conducting research that has the potential for impacting academic and/or policy. Graduates are often considered for economic think-tanks and can find work with various government departments and international organizations. They have a broad set of tools for understanding and analyzing social world trends, evaluating causes, and identifying possible interventions. Without a doubt, professionals with PhD degrees in economics are well-regarded and highly desired by prospective employers.

Graduates from these high-level programs generally have one of two career goals: conducting research in economics academia or providing economics research data to a non-academic sector (i.e., government, international organizations, or non-profits). In either type of position, these professionals have significant advocacy potential and have the ability to influence policy through their research.

Jobs

Earning an economics degree can open many doors that lead to a wide variety of career opportunities. It’s not uncommon for graduates to start out by finding work in banking, accountancy, business, finance consultancy, actuarial and data economic analysis, or even the public sector.

Some of the most common positions include:

- Economist

- Financial Risk Analyst

- Data Analyst

- Financial Planner

- Accountant

- Economic Researcher

- Financial Consultant

- Investment Analyst

- Actuary

- Management Consultant

- Research Assistant

- Sales Analyst

- Operations Research Analyst

- Statistician

- Survey Researcher

- Political Scientist

- Investment Analyst

Investment analysts are responsible for helping review and potentially approve investment products. These professionals often provide portfolio management recommendations, as well as make suggestions regarding asset allocation and the full range of investment products. They regularly conduct research and economic analysis to evaluate the financial performance of various companies and industries. According to PayScale, investment analysts make an average base salary of $74,900 per year. - Accountant

Accountants are responsible for performing a wide variety of financial services for individuals, companies, and/or organizations. Specific duties vary, but these professionals commonly create cash flow reports, administer payroll, maintain balance sheets, perform various billing activities, keep inventories, and manage budgets for their clients. According to PayScale, accountants make an average base salary of $58,500 per year. - Statistician

Statisticians are responsible for analyzing a variety of data which is used to supplement the knowledge of professionals or businesses within the private and public sectors. Using appropriate, up-to-date methods, as well as different mathematical techniques and specialized software, these professionals process and analyze data before summarizing the results for their employers. According to PayScale, statisticians make an average base salary of $91,400 per year. - Financial Consultant

Financial consultants are responsible for advising clients on the best way to manage their money. These professionals often work for investment banks or financial service companies to assess customers’ financial needs and build an appropriate investment portfolio. They often work clients through financial self-analysis, assist with goal-setting, and provide advice. According to PayScale, financial consultants make an average base salary of $77,800 per year. - Data Analyst

Data analysts are responsible for using data to acquire information about specific topics for their employers. These professionals often utilize surveys to gather the necessary information before interpreting the results and presenting them to important stakeholders. They regularly create detailed charts and reports to depict their findings. According to PayScale, data analysts make an average base salary of $68,400 per year. - Political Scientist

Political scientists are responsible for performing, analyzing, and presenting research to their employers. These professionals may be familiar with various aspects of the field including political parties, national security, and international relations. They regularly provide advice regarding policy, as well as write papers and reports for publication. According to PayScale, political scientists make an average base salary of $60,000 per year.

Find Economist Jobs Near You

Frequently Asked Questions

What is the job outlook for roles in this field?

The career opportunities and job openings for an economist will grow by 13% by 2030.

What do policy analysts do?

Policy analysts identify problems, create solutions, and evaluate solutions. Policy analysts develop government policies while providing advice to senior management and ministers.

How much do policy analysts make?

Policy analysts make around $108,000 per year.

Search All Programs