University HQ is an industry-leading, independent educational organization that provides independent college rankings using a proprietary formula to create first class unbiased rankings. The team at University Headquarters strives to provide accurate and trustworthy rankings that highlights the best business accounting programs.

Accounting has become one of the most dynamic and lucrative industries in recent years, presenting a plethora of opportunities for those who choose to pursue this career path. Whether you're a seasoned professional or just starting your journey, understanding the education paths, certifications, and career options available can help streamline your progression. From degrees in finance and accounting to specialized certifications like CPA (Certified Public Accountant) and CMA (Certified Management Accountant), the resources at our disposal are both diverse and robust.

Educational resources for accounting are abundant, with numerous universities offering dedicated programs tailored to different interests. These range from bachelor’s degrees in accounting to more advanced studies like a master’s in accounting or finance. Additionally, certifications such as the Enrolled Agent (EA) designation, awarded by the IRS, can open specific career doors. Engaging with these resources prepares us to meet the demands of various sectors, including finance, insurance, and public administration.

Our career options expand significantly with the right credentials and skills. Salaries for accountants reflect the high demand and the value of these roles, with figures like $79,880 (BLS Accountants Salary) noted as the median annual wage. CPAs and CMAs can command even higher salaries, averaging around $101,000 to $119,000 per year. These figures underscore the rewarding potential of careers in accounting and highlight the importance of continued education and certification in maximizing your career prospects.

Featured Online Programs

What is Accounting?

Accounting is the systematic process of recording, analyzing, and reporting financial transactions. This field encompasses a wide range of activities, from tracking income and expenses to ensuring compliance with financial regulations.

Role in Business

The role of accounting is integral to any business or organization. Accountants are responsible for preparing financial statements, managing budgets, and conducting audits. They help organizations understand their financial health through detailed reports.

To enter this field, individuals typically pursue a bachelor's degree in accounting. Many continue their education with a master's degree or specialized certifications. Key certifications include Certified Public Accountant (CPA), Certified Management Accountant (CMA), and Certified Internal Auditor (CIA). Each of these designations requires passing rigorous exams and meeting specific educational requirements.

Our role as accountants also extends to financial advisory, where we provide insights based on financial data. This helps in strategic planning and decision-making, making our expertise invaluable to our clients and organizations.

Accounting Education and Certifications

In the field of accounting, education and certifications play a crucial role in shaping our careers and enhancing our professional skills. Both formal education and various certifications provide us with the knowledge and qualifications needed to excel in various accounting roles.

Associate Degree in Accounting

An associate degree in accounting typically takes two years to complete and offers a foundational understanding of accounting principles. This program is ideal for those looking to enter the workforce quickly as bookkeepers, accounting clerks, or auditing clerks.

Many community colleges offer this degree, which covers subjects such as financial accounting, managerial accounting, and tax accounting. Upon completion, we can either start working immediately or transfer credits to a four-year institution for further education.

Bachelor's Degree in Accounting

A bachelor’s degree in accounting is often required for many entry-level positions in the field. This four-year program provides us with comprehensive knowledge in accounting, auditing, and bookkeeping. It also focuses on business and finance-related subjects, equipping us with a holistic understanding of the business world.

Graduates often pursue roles like staff accountant, auditor, or financial analyst. Additionally, a bachelor's degree is usually a prerequisite for advanced certifications like the Certified Public Accountant (CPA).

Master's Degree in Accounting

A master’s degree in accounting is designed for those who wish to deepen their expertise and advance their careers. This program usually takes one to two years and focuses on advanced accounting techniques, financial reporting, and auditing.

Having a master’s degree can make us more competitive in the job market and often leads to higher-level positions such as senior auditor, controller, or financial manager. It also fulfills the credit requirements for CPA certification in many states.

MBA Degree in Accounting

An MBA degree with a focus in accounting merges traditional business education with specialized accounting training. This degree can be completed in two years and provides us with the skills to handle complex business issues along with advanced accounting problems.

This program is beneficial for those aiming for leadership roles like Chief Financial Officer (CFO) or finance director. It also covers essential subjects such as strategic management, financial risk management, and corporate finance.

PhD Degree in Accounting

A PhD in Accounting is the highest level of academic achievement in this field and is typically pursued by those interested in research or academic careers. This program can take four to six years and involves extensive coursework in accounting theory, advanced research methods, and statistical analysis.

Graduates often go on to become university professors, researchers, or high-level consultants. Holding a PhD can also open doors to influential positions in policy-making and academic administration.

Accounting Certifications

Accounting certifications are essential for validating our skills and increasing our job prospects. The Certified Public Accountant (CPA) is the most recognized certification, requiring passing the CPA exam and meeting state-specific education and experience requirements.

Other notable certifications include the Certified Management Accountant (CMA), awarded by the Institute of Management Accountants (IMA). The CMA focuses on managerial accounting and financial management skills.

Each certification has unique eligibility standards, and we should choose one that aligns with our career goals. These credentials not only enhance our expertise but also provide opportunities for advancement and specialized roles in the accounting industry.

Essential Skills and Knowledge

Our journey into the field of accounting highlights key skills and knowledge areas that professionals must master. These include fundamental accounting skills, technological proficiency, and a thorough understanding of laws and regulations.

Fundamental Skills

To achieve success in accounting, we need a robust set of fundamental skills. Knowledge in financial accounting, management accounting, and tax accounting is crucial.

We focus on maintaining accurate records, preparing financial statements, and understanding generally accepted accounting principles (GAAP). Critical thinking and problem-solving abilities are essential for addressing reporting errors and ethical dilemmas.

Soft skills such as effective communication and collaboration play significant roles as well. Listening actively and responding to clients’ needs helps deepen our client relationships.

Technological Proficiency

Technology is reshaping the accounting industry, and proficiency with various accounting software is indispensable. Mastery of Excel and specialized platforms like QuickBooks or SAP is essential for efficient data management and analysis.

We must also be familiar with emerging technologies such as AI and blockchain, which are transforming traditional accounting practices. Understanding how to leverage these tools can greatly enhance accuracy and productivity.

Continuous learning and adapting to new software updates and innovations ensure we remain competitive in the industry.

Understanding of Laws and Regulations

A thorough understanding of the laws and regulations governing accounting practices is vital. We need to stay updated with tax laws, accounting standards, and compliance requirements.

Knowledge of GAAP and other regulatory frameworks guides our practice in maintaining accurate and lawful financial records. In specialized fields like forensic accounting, understanding legal standards aids in investigations.

Staying informed about changes in tax regulations helps us provide accurate advice and services to our clients, ensuring adherence to legal requirements. This vigilance protects our professionalism and credibility.

Career Opportunities in Accounting

Let's explore where accountants work, the differences between private and public accounting, and various accounting career options. Each of these areas offers unique opportunities, work environments, and earning potential.

Where Accountants Work

Accountants find employment in diverse settings. Corporate accounting involves working for a specific company, managing their finances, and ensuring compliance with financial regulations. Public accounting firms offer services like auditing, tax preparation, and consulting to a range of clients.

Government agencies and non-profits also hire accountants to manage financial reporting, budgeting, and auditing. Accounting professionals can also be found in educational institutions and healthcare organizations, where they handle funding, grants, and cost management.

Private vs Public Accounting

Private accounting involves working within a single organization. These roles typically include management accounting, internal auditing, and financial analysis. Private accountants are responsible for preparing internal financial documents and aiding in strategic planning.

Public accounting, on the other hand, provides services to a variety of clients. Public accountants often work for accounting firms where they perform audits, prepare taxes, and provide financial consulting. They can choose to specialize in areas like tax accounting or forensic accounting. Licensure such as a CPA (Certified Public Accountant) is often required for many public accounting roles.

Different careers offer varying salaries and growth opportunities. For instance, CPAs and professionals with specialized certifications often command higher pay. Sectors can also influence earnings; accountants in finance and insurance typically earn more compared to other industries.

Explore All Accounting Careers Explore Accounting Salaries by StateResources for Accounting Professionals

Accounting professionals have access to a broad array of resources that support their career advancement, enhance their skills, and aid them in staying updated with industry standards.

Professional Associations and Networks

Professional associations play a crucial role for accountants. Organizations like the National Association of State Boards of Accountancy (NASBA) provide essential regulatory insights and educational resources. Membership in NASBA allows access to licensing information, continuing professional education (CPE) programs, and networking opportunities.

Meanwhile, the Institute of Management Accountants (IMA) offers tools that cater to those focusing on management accounting. IMA membership includes access to research, certifications like the CMA (Certified Management Accountant), and professional development webinars. AICPA (American Institute of CPAs) also supports accountants with resources such as audit and assurance services, ethical guidelines, and professional growth seminars. Subscribing to their newsletters ensures that members receive timely updates relevant to their practice.

Tools and Software Applications

In today's technology-driven environment, using the right tools and software is essential for efficiency and accuracy. FASB Accounting Standards Codification is a vital resource for GAAP guidelines, essential for accountants working in non-governmental entities. We can access its basic version for free, and for more detailed features, there’s a professional subscription available.

Moreover, CPAs benefit from continuing professional education (CPE) courses offered by AICPA which include over 350 self-study courses covering diverse accounting topics. Leveraging software like QuickBooks, Sage, and SAP can streamline tasks such as bookkeeping, payroll management, and financial reporting. Additionally, cloud-based solutions offer greater flexibility and real-time collaboration, making it easier to manage accounting functions remotely and securely.

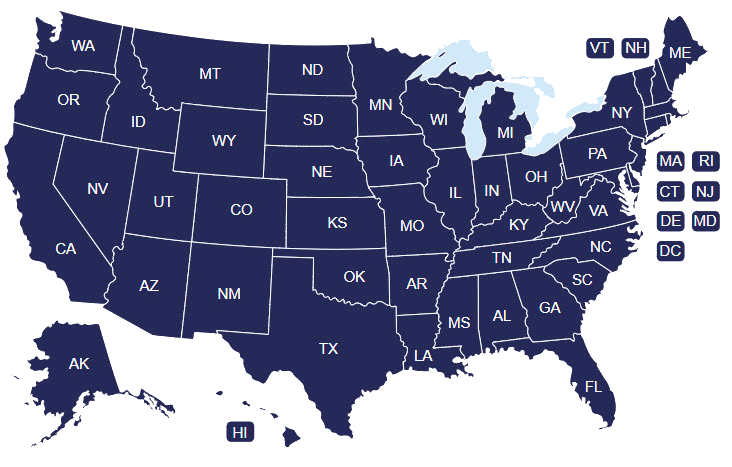

Explore All Accounting ResourcesState-By-State Accounting College Rankings

Select a State to Search Colleges & Universities

- Select a State

-

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- District of Columbia

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

Search All Programs