University HQ is an industry-leading, independent educational organization that provides independent college rankings using a proprietary formula to create first class unbiased rankings. The team at University Headquarters strives to provide accurate and trustworthy rankings that highlights the best programs in accounting.

Are you interested in pursuing a career in accounting? If you think you might enjoy working with financial information and records, or you're just looking for career opportunities that will allow you to earn a more than adequate income, this may be an ideal profession. While specific job responsibilities vary depending on the industry you work for and whether you've made it past an entry-level position, most accountants and auditors are tasked with assessing a company or organizations financial operations to ensure future success and efficiency. Other common duties of an accounting career include:

- Keep track of all relevant financial statements and records

- Review financial reports to verify compliance with the accounting firm's or organizations regulations, as well as national and state laws

- Oversee company or organization’s tax responsibilities, including preparing tax documents and ensuring taxes are paid

- Examine departmental account books to ensure adherence to established accounting procedures

- Establish and maintain efficient accounting systems and regulations

- Evaluate company or organization’s financial operations and recommend better management procedures when necessary

- Generate written and verbal financial reports for management and clients as needed

- Communicate financial findings to company or organization decision-makers

- Provide suggestions regarding ways to reduce costs and spending, improve profitability, and boost financial returns

Because most industries require financial oversight, those with an online accounting degree can easily find work within numerous fields, including accounting education. To better accommodate specific workplaces and positions, these professionals often choose to specialize with additional studies and educational certificates. The most common types of accountants found in accounting firms and large and small businesses across the U.S. are public accountants, management accountants, forensic accounting professionals, and government accountants.

Featured Online Accounting Programs

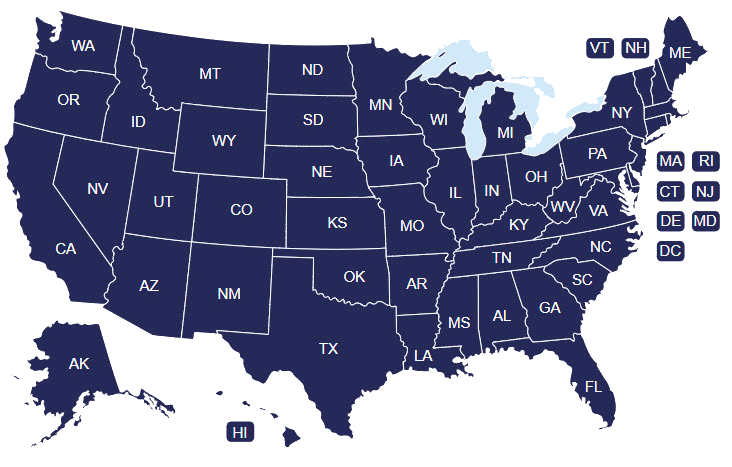

State-By-State Accounting College Rankings

Select a State to Search Colleges & Universities

- Select a State

-

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- District of Columbia

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

Step by Step Overview to Become an Accountant

Not everyone is capable of creating a successful accounting career in the real world. The field is extremely demanding and requires substantial education, training, and experience. Specifically, you will most likely need at least a bachelor's in accounting to succeed, though you might start out earning a bachelor of business administration with an emphasis in financial accounting and still have a stellar accounting career. Because the job of an accountant is multifaceted, these professionals must develop and hone many important skills. The following traits are essential for an accounting career, regardless of the field these professionals choose to work in or if they ever choose to earn an advanced online accounting degree:

- Excellent organization of financial statements and data, including figures and paperwork

- Time management skills that allow for multi-tasking and the effective use of office hours

- Detail-oriented nature and an eye for accuracy, especially when dealing with financial figures

- Exceptional customer service when working directly with clients

- Creativity that allows for out-of-the-box thinking and quick, fresh solutions to financial problems

- Commitment to and passion for the industry

- Unwavering trustworthiness regarding private and confidential company and client information

- Outstanding communication with clients and company or organization management

- Collaboration with team members, department managers, and decision-makers

- Flexibility to work effectively in constantly changing environments and address last-minute challenges

Becoming an accountant or CPA is not an easy task. It takes hard work and dedication. However, a simplified, step-by-step explanation of the process consists of the following:

-

Earn an undergraduate online accounting degree

-

Decide between a career as an accountant and a CPA

-

Earn a graduate online accounting degree

-

Find an entry-level position working under a certified CPA

-

Submit the CPA licensure application

-

Apply for, take, and pass the Uniform CPA Exam (The overall 2021 CPA exam pass rate is 54%)

-

Enroll in continuing education accounting courses

What is the Difference Between a CPA and an Accountant?

A Certified Public Accountant, or CPA, is an accountant who is licensed to practice. While the licensing requirements vary from state to state, most CPAs must complete a minimum level of formal education, obtain professional experience, and successfully pass the Uniform CPA Examination.

A Certified Public Accountant, or CPA, is an accountant who is licensed to practice. While the licensing requirements vary from state to state, most CPAs must complete a minimum level of formal education, obtain professional experience, and successfully pass the Uniform CPA Examination.

There are many reasons that an accountant may want to become a CPA. For instance, CPAs are legally permitted to provide more services to their clients. While accountants can prepare taxes, only CPAs can represent an individual before the IRS during an audit. Additionally, professionals with a CPA designation are typically better regarded and make more money. In fact, it’s not uncommon for CPAs to make 10 to 15 percent more than accountants without licensing.

Typical Online Requirements

Accountants must attain, at minimum, an undergraduate online accounting degree. These online degrees generally consist of 120 credit hours of coursework, made up of both general curriculum and specialized major accounting courses. While every online accounting program is a little different, most require online students to take classes like financial accounting, accounting information systems, income tax, tax accounting, corporate accounting, cost and managerial accounting, and auditing.

In most cases, bachelor's degrees in accounting take four years to complete. There are, however, some accelerated online programs available. Full-time students with previously-earned college credit hours or associate degrees can also finish sooner, whereas students who plan to attend school part-time may still take longer.

While accountants are not required to earn an advanced online accounting degree, master's degrees from an online accounting program may be extremely beneficial in this industry. Not only does a master’s degree in accounting qualify professionals for higher-paying positions, it also prepares them to deal with more advanced work in auditing, taxation, and finance. Completing a graduate online accounting degree also helps fulfill the 150 credit hour requirement most states have for certified public accountant (CPA) licensure.

Required Academic Standards

A bachelor’s online accounting degree is enough to qualify candidates for most entry-level finance positions, but professionals seeking CPA certification must take their education further. While each state’s “board of accountancy” sets its own licensing requirements, most have similar education standards. Typically, states require candidates to complete the following:

- A bachelor’s degree in accounting or a related field from an accredited college or university

- A minimum of 150 semester credit hours of accounting and/or business coursework

- A specific number of accounting courses that cover certain topics

- A specific number of business courses that cover certain topics

Many states require that CPA certification candidates maintain an established minimum GPA while in school. Additionally, once an individual becomes officially certified as a CPA, they must complete a certain number of Continuing Professional Education (CPE) online courses each year. Failing to provide proof of CPE credits can result in a CPA license being revoked.

CPA Exam and Experience

After completing the above-mentioned education requirements, CPA exam candidates must apply to take the Uniform CPA Exam. This process usually entails submitting an application fee, official school transcripts, reference letters, and any supporting legal documents. Once approved, access to the exam schedule is provided.

The Uniform CPA Exam consists of four sections: Auditing and Attestation, Business Environment and Concepts, Financial Accounting and Reporting, and Regulation. Each test is four hours long and candidates must pass all of them within an 18-month period. Most states require a minimum passing score of 75 for each section.

While not nearly as difficult, most states also require CPA candidates to take and pass an ethics examination. These are generally offered online and can be taken independently.

Additionally, CPA candidates must provide proof of professional experience. Again, this requirement varies significantly from state to state. Most boards require candidates to work professionally under the direct supervision of a CPA for at least two years. Proof of work experience in accounting, auditing, insurance reporting, provision of management advisory, and/or financial consulting must be submitted before CPA licensure can be granted.

Top Certifications to Consider

In addition to CPA licensure, there are several other certifications that accountants may consider seeking. Some of the most popular options are:

- Certified Financial Analyst (CFA)

- Certified Management Accountant (CMA)

- Enrolled Agent (EA)

- Certified Internal Auditor (CIA)

- Certified Information Systems Auditor (CISA)

- Certified Fraud Examiner (CFE)

- Certified Government Auditing Professional (CGAP)

- Certified Bank Auditor (CBA)

Find Programs Offering Accounting Majors

Individuals interested in accounting have several college degree options. In fact, every online program level offers some form of accounting program.

Associates Degree in Accounting

An online associate’s degree in accounting is ideal for people who want to begin a career in finance as soon as possible. Instead of being in school for four or more years, online students can graduate in as little as one to two with basic knowledge of the field. While online programs vary, most associate degrees are approximately 60 credit hours of coursework and provide a foundation in cost accounting, taxation, financial statement analysis, and payroll accounting. These types of online accounting degree programs prepare online students in accounting for entry-level accounting positions like billing clerk, bookkeepers, payroll clerk, accounting assistant, and accounts receivable clerk. Every college and university is different, but coursework frequently covers:

Sample Courses

- Accounting

- Principles of Financial Accounting

- Principles of Macroeconomics and Microeconomics

- Introduction to Business Logic and Ethics

- Payroll Accounting

- Business Communication

- Accounting Information Systems

- Business Law

- Tax Law

- Cost Accounting

- Business Income Taxes

- Integrated Accounting Applications

Best Online Associate Degrees in Accounting Rankings

American Public University System

Score: 79.7

- Undergraduate Tuition

- In-State: $8,400

- Out-of-State:$8,400

- Net Price: $10,322

- Acceptance Rate: 100%

- Retention Rate: 94%

- Graduation Rate: 53%

- Total Enrollment: 50,187

- Undergrad Students: 40,478

- Graduate Students: 9,709

- Grads Salary: $53,700

- Student-to-faculty: 25:1

Foothill College

Score: 79.68

- Undergraduate Tuition

- In-State: $1,565

- Out-of-State:$12,320

- Net Price: $9,665

- Acceptance Rate: 100%

- Retention Rate: 100%

- Graduation Rate: 60%

- Total Enrollment: 12,931

- Undergrad Students: 12,931

- Graduate Students: N/A

- Grads Salary: $48,800

- Student-to-faculty: 22:1

Indiana Wesleyan University

Score: 79.58

- Undergraduate Tuition

- In-State: $31,168

- Out-of-State:$31,168

- Net Price: $23,364

- Acceptance Rate: 82%

- Retention Rate: 79%

- Graduation Rate: 66%

- Total Enrollment: 2,207

- Undergrad Students: 2,079

- Graduate Students: 128

- Grads Salary: $52,700

- Student-to-faculty: 12:1

Elizabethtown College

Score: 77.49

- Undergraduate Tuition

- In-State: $36,842

- Out-of-State:$36,842

- Net Price: $27,019

- Acceptance Rate: 77%

- Retention Rate: 84%

- Graduation Rate: 77%

- Total Enrollment: 2,152

- Undergrad Students: 1,857

- Graduate Students: 295

- Grads Salary: $46,000

- Student-to-faculty: 12:1

Herzing University-Minneapolis

Score: 76.62

- Undergraduate Tuition

- In-State: $13,420

- Out-of-State:$13,420

- Net Price: $15,275

- Acceptance Rate: 94%

- Retention Rate: 57%

- Graduation Rate: 74%

- Total Enrollment: 752

- Undergrad Students: 748

- Graduate Students: 4

- Grads Salary: $45,200

- Student-to-faculty: 14:1

Fox Valley Technical College

Score: 74.39

- Undergraduate Tuition

- In-State: $4,916

- Out-of-State:$7,109

- Net Price: $10,187

- Acceptance Rate: 100%

- Retention Rate: 68%

- Graduation Rate: 61%

- Total Enrollment: 10,995

- Undergrad Students: 10,995

- Graduate Students: N/A

- Grads Salary: $43,900

- Student-to-faculty: 13:1

Northwest Iowa Community College

Score: 73.71

- Undergraduate Tuition

- In-State: $7,110

- Out-of-State:$7,410

- Net Price: $13,084

- Acceptance Rate: 100%

- Retention Rate: 70%

- Graduation Rate: 55%

- Total Enrollment: 1,792

- Undergrad Students: 1,792

- Graduate Students: N/A

- Grads Salary: $47,600

- Student-to-faculty: 16:1

Davenport University

Score: 71.82

- Undergraduate Tuition

- In-State: $23,324

- Out-of-State:$23,324

- Net Price: $19,799

- Acceptance Rate: 97%

- Retention Rate: 74%

- Graduation Rate: 50%

- Total Enrollment: 4,848

- Undergrad Students: 3,833

- Graduate Students: 1,015

- Grads Salary: $50,600

- Student-to-faculty: 18:1

Champlain College

Score: 70.92

- Undergraduate Tuition

- In-State: $45,550

- Out-of-State:$45,550

- Net Price: $36,846

- Acceptance Rate: 67%

- Retention Rate: 77%

- Graduation Rate: 63%

- Total Enrollment: 3,328

- Undergrad Students: 2,886

- Graduate Students: 442

- Grads Salary: $49,000

- Student-to-faculty: 13:1

Chippewa Valley Technical College

Score: 69.26

- Undergraduate Tuition

- In-State: $4,724

- Out-of-State:$6,917

- Net Price: $10,766

- Acceptance Rate: 100%

- Retention Rate: 70%

- Graduation Rate: 46%

- Total Enrollment: 8,198

- Undergrad Students: 8,198

- Graduate Students: N/A

- Grads Salary: $43,600

- Student-to-faculty: 13:1

University of Alaska Anchorage

Score: 69.11

- Undergraduate Tuition

- In-State: $7,566

- Out-of-State:$21,693

- Net Price: $13,931

- Acceptance Rate: 67%

- Retention Rate: 72%

- Graduation Rate: 29%

- Total Enrollment: 10,796

- Undergrad Students: 10,162

- Graduate Students: 634

- Grads Salary: $49,100

- Student-to-faculty: 12:1

Gateway Technical College

Score: 68.4

- Undergraduate Tuition

- In-State: $4,853

- Out-of-State:$7,046

- Net Price: $7,902

- Acceptance Rate: 100%

- Retention Rate: 74%

- Graduation Rate: 47%

- Total Enrollment: 10,134

- Undergrad Students: 10,134

- Graduate Students: N/A

- Grads Salary: $40,100

- Student-to-faculty: 14:1

Moraine Park Technical College

Score: 68

- Undergraduate Tuition

- In-State: $4,713

- Out-of-State:$6,917

- Net Price: $10,074

- Acceptance Rate: 100%

- Retention Rate: 75%

- Graduation Rate: 50%

- Total Enrollment: 3,532

- Undergrad Students: 3,532

- Graduate Students: N/A

- Grads Salary: $38,900

- Student-to-faculty: 12:1

University of Alaska Fairbanks

Score: 67.71

- Undergraduate Tuition

- In-State: $8,640

- Out-of-State:$22,752

- Net Price: $9,985

- Acceptance Rate: 100%

- Retention Rate: 72%

- Graduation Rate: 32%

- Total Enrollment: 6,640

- Undergrad Students: 5,638

- Graduate Students: 1,002

- Grads Salary: $46,700

- Student-to-faculty: 12:1

Stanly Community College

Score: 67.66

- Undergraduate Tuition

- In-State: $2,672

- Out-of-State:$8,816

- Net Price: $5,001

- Acceptance Rate: 100%

- Retention Rate: 72%

- Graduation Rate: 72%

- Total Enrollment: 2,527

- Undergrad Students: 2,527

- Graduate Students: N/A

- Grads Salary: $26,000

- Student-to-faculty: 10:1

Northcentral Technical College

Score: 67.35

- Undergraduate Tuition

- In-State: $3,861

- Out-of-State:$5,615

- Net Price: $11,047

- Acceptance Rate: 100%

- Retention Rate: 74%

- Graduation Rate: 49%

- Total Enrollment: 5,838

- Undergrad Students: 5,838

- Graduate Students: N/A

- Grads Salary: $40,000

- Student-to-faculty: 16:1

- Undergraduate Tuition

- In-State: $6,554

- Out-of-State:$13,786

- Net Price: $8,892

- Acceptance Rate: 100%

- Retention Rate: 70%

- Graduation Rate: 25%

- Total Enrollment: 8,324

- Undergrad Students: 8,324

- Graduate Students: N/A

- Grads Salary: $50,200

- Student-to-faculty: 20:1

Shoreline Community College

Score: 66.86

- Undergraduate Tuition

- In-State: $4,388

- Out-of-State:$7,430

- Net Price: $11,767

- Acceptance Rate: 100%

- Retention Rate: 54%

- Graduation Rate: 32%

- Total Enrollment: 4,460

- Undergrad Students: 4,460

- Graduate Students: N/A

- Grads Salary: $49,400

- Student-to-faculty: 14:1

Southeast Technical College

Score: 66.83

- Undergraduate Tuition

- In-State: $7,650

- Out-of-State:$7,650

- Net Price: $15,265

- Acceptance Rate: 100%

- Retention Rate: 71%

- Graduation Rate: 51%

- Total Enrollment: 2,478

- Undergrad Students: 2,478

- Graduate Students: N/A

- Grads Salary: $40,100

- Student-to-faculty: 11:1

Northwest Nazarene University

Score: 66.76

- Undergraduate Tuition

- In-State: $39,370

- Out-of-State:$39,370

- Net Price: $27,291

- Acceptance Rate: 63%

- Retention Rate: 79%

- Graduation Rate: 60%

- Total Enrollment: 1,774

- Undergrad Students: 1,156

- Graduate Students: 618

- Grads Salary: $39,000

- Student-to-faculty: 14:1

Northeast Wisconsin Technical College

Score: 66.71

- Undergraduate Tuition

- In-State: $4,904

- Out-of-State:$7,097

- Net Price: $9,533

- Acceptance Rate: 100%

- Retention Rate: 77%

- Graduation Rate: 46%

- Total Enrollment: 10,815

- Undergrad Students: 10,815

- Graduate Students: N/A

- Grads Salary: $39,200

- Student-to-faculty: 16:1

Northwood Technical College

Score: 66.64

- Undergraduate Tuition

- In-State: $4,524

- Out-of-State:$6,583

- Net Price: $8,654

- Acceptance Rate: 100%

- Retention Rate: 74%

- Graduation Rate: 51%

- Total Enrollment: 2,668

- Undergrad Students: 2,668

- Graduate Students: N/A

- Grads Salary: $34,900

- Student-to-faculty: 7:1

Southwestern Community College-Creston

Score: 66.59

- Undergraduate Tuition

- In-State: $7,024

- Out-of-State:$7,248

- Net Price: $10,809

- Acceptance Rate: 100%

- Retention Rate: 74%

- Graduation Rate: 53%

- Total Enrollment: 1,633

- Undergrad Students: 1,633

- Graduate Students: N/A

- Grads Salary: $37,100

- Student-to-faculty: 16:1

Central Penn College

Score: 66.53

- Undergraduate Tuition

- In-State: $19,404

- Out-of-State:$19,404

- Net Price: $18,681

- Acceptance Rate: 26%

- Retention Rate: 64%

- Graduation Rate: 39%

- Total Enrollment: 827

- Undergrad Students: 806

- Graduate Students: 21

- Grads Salary: $40,400

- Student-to-faculty: 8:1

Northeast Community College

Score: 66.5

- Undergraduate Tuition

- In-State: $3,840

- Out-of-State:$5,130

- Net Price: $8,508

- Acceptance Rate: 100%

- Retention Rate: 71%

- Graduation Rate: 56%

- Total Enrollment: 5,595

- Undergrad Students: 5,595

- Graduate Students: N/A

- Grads Salary: $36,100

- Student-to-faculty: 22:1

Bachelor’s Degree in Accounting

A four-year undergraduate degree in accounting is a fantastic launchpad for a stellar career. During your college years you will receive the training necessary to join an accounting firm, a financial team, or any sort of business. If you have graduated from an online baccalaureate program but did not major in accounting, you might later consider a post bachelorettes certificate. You might need the courses to get a new job at your firm, you could be considering a CPA license, or you might wish some other credentials. There are many reasons to obtain an online undergraduate accounting bachelors diploma and some of the courses you may see are:

Sample Courses

- Business Communication for Accountants

- Introduction to Computer Applications and Systems

- Principles of Macroeconomics and Microeconomics

- Managerial and Cost Accounting

- Human Resources Management

- Supply-Chain Operations

- Principles of Accounting I

- Principles of Accounting II

- Contemporary Business Law

- Personal Finance

- Auditing

- Cross-Cultural Negotiation

- Intermediate Financial Accounting I, II, III

Best Online Bachelor's Degrees in Accounting Rankings

Northeastern University

Score: 81.57

- Undergraduate Tuition

- In-State: $63,141

- Out-of-State:$63,141

- Net Price: $34,770

- Acceptance Rate: 6%

- Retention Rate: 98%

- Graduation Rate: 90%

- Total Enrollment: 31,159

- Undergrad Students: 15,891

- Graduate Students: 15,268

- Grads Salary: $87,000

- Student-to-faculty: 16:1

University of Massachusetts-Amherst

Score: 79.62

- Undergraduate Tuition

- In-State: $17,357

- Out-of-State:$39,293

- Net Price: $22,954

- Acceptance Rate: 58%

- Retention Rate: 91%

- Graduation Rate: 83%

- Total Enrollment: 31,810

- Undergrad Students: 23,936

- Graduate Students: 7,874

- Grads Salary: $82,000

- Student-to-faculty: 18:1

University of South Florida

Score: 79.56

- Undergraduate Tuition

- In-State: $6,410

- Out-of-State:$17,324

- Net Price: $11,578

- Acceptance Rate: 41%

- Retention Rate: 91%

- Graduation Rate: 75%

- Total Enrollment: 48,572

- Undergrad Students: 37,269

- Graduate Students: 11,303

- Grads Salary: $73,000

- Student-to-faculty: 22:1

Auburn University

Score: 75.37

- Undergraduate Tuition

- In-State: $12,536

- Out-of-State:$33,944

- Net Price: $24,524

- Acceptance Rate: 50%

- Retention Rate: 93%

- Graduation Rate: 79%

- Total Enrollment: 33,015

- Undergrad Students: 26,874

- Graduate Students: 6,141

- Grads Salary: $76,000

- Student-to-faculty: 21:1

University of Arizona

Score: 74.51

- Undergraduate Tuition

- In-State: $13,626

- Out-of-State:$41,095

- Net Price: $18,144

- Acceptance Rate: 86%

- Retention Rate: 88%

- Graduation Rate: 66%

- Total Enrollment: 53,001

- Undergrad Students: 41,899

- Graduate Students: 11,102

- Grads Salary: $80,000

- Student-to-faculty: 19:1

Arizona State University

Score: 74.28

- Undergraduate Tuition

- In-State: $12,051

- Out-of-State:$32,193

- Net Price: $16,401

- Acceptance Rate: 90%

- Retention Rate: 85%

- Graduation Rate: 68%

- Total Enrollment: 79,593

- Undergrad Students: 65,174

- Graduate Students: 14,419

- Grads Salary: $77,000

- Student-to-faculty: 18:1

Florida Atlantic University

Score: 73.97

- Undergraduate Tuition

- In-State: $4,879

- Out-of-State:$17,324

- Net Price: $9,839

- Acceptance Rate: 73%

- Retention Rate: 84%

- Graduation Rate: 64%

- Total Enrollment: 30,790

- Undergrad Students: 24,614

- Graduate Students: 6,176

- Grads Salary: $71,000

- Student-to-faculty: 23:1

Washington State University

Score: 73.64

- Undergraduate Tuition

- In-State: $12,997

- Out-of-State:$29,073

- Net Price: $18,155

- Acceptance Rate: 85%

- Retention Rate: 80%

- Graduation Rate: 62%

- Total Enrollment: 26,490

- Undergrad Students: 21,923

- Graduate Students: 4,567

- Grads Salary: $81,000

- Student-to-faculty: 15:1

University of Mary

Score: 73.61

- Undergraduate Tuition

- In-State: $21,468

- Out-of-State:$21,468

- Net Price: $19,225

- Acceptance Rate: 78%

- Retention Rate: 83%

- Graduation Rate: 68%

- Total Enrollment: 3,794

- Undergrad Students: 2,650

- Graduate Students: 1,144

- Grads Salary: $75,000

- Student-to-faculty: 10:1

Regis University

Score: 73.58

- Undergraduate Tuition

- In-State: $43,980

- Out-of-State:$43,980

- Net Price: $25,062

- Acceptance Rate: 87%

- Retention Rate: 75%

- Graduation Rate: 61%

- Total Enrollment: 4,631

- Undergrad Students: 2,680

- Graduate Students: 1,951

- Grads Salary: $89,000

- Student-to-faculty: 9:1

The University of West Florida

Score: 73.57

- Undergraduate Tuition

- In-State: $6,360

- Out-of-State:$19,241

- Net Price: $8,908

- Acceptance Rate: 57%

- Retention Rate: 88%

- Graduation Rate: 62%

- Total Enrollment: 14,371

- Undergrad Students: 9,661

- Graduate Students: 4,710

- Grads Salary: $67,000

- Student-to-faculty: 22:1

SUNY Polytechnic Institute

Score: 73.44

- Undergraduate Tuition

- In-State: $8,578

- Out-of-State:$20,228

- Net Price: $14,646

- Acceptance Rate: 78%

- Retention Rate: 68%

- Graduation Rate: 59%

- Total Enrollment: 2,704

- Undergrad Students: 1,904

- Graduate Students: 800

- Grads Salary: $80,000

- Student-to-faculty: 14:1

American Public University System

Score: 73.36

- Undergraduate Tuition

- In-State: $8,400

- Out-of-State:$8,400

- Net Price: $10,322

- Acceptance Rate: 100%

- Retention Rate: 94%

- Graduation Rate: 53%

- Total Enrollment: 50,187

- Undergrad Students: 40,478

- Graduate Students: 9,709

- Grads Salary: $79,000

- Student-to-faculty: 25:1

University of Arkansas

Score: 72.95

- Undergraduate Tuition

- In-State: $9,748

- Out-of-State:$28,772

- Net Price: $17,475

- Acceptance Rate: 72%

- Retention Rate: 86%

- Graduation Rate: 70%

- Total Enrollment: 32,140

- Undergrad Students: 27,472

- Graduate Students: 4,668

- Grads Salary: $72,000

- Student-to-faculty: 20:1

Maryville University of Saint Louis

Score: 72.68

- Undergraduate Tuition

- In-State: $27,166

- Out-of-State:$27,166

- Net Price: $26,733

- Acceptance Rate: 94%

- Retention Rate: 83%

- Graduation Rate: 72%

- Total Enrollment: 9,883

- Undergrad Students: 6,062

- Graduate Students: 3,821

- Grads Salary: $82,000

- Student-to-faculty: 13:1

Southern Illinois University-Carbondale

Score: 70.91

- Undergraduate Tuition

- In-State: $13,244

- Out-of-State:$13,244

- Net Price: $16,131

- Acceptance Rate: 90%

- Retention Rate: 69%

- Graduation Rate: 56%

- Total Enrollment: 11,359

- Undergrad Students: 8,195

- Graduate Students: 3,164

- Grads Salary: $78,000

- Student-to-faculty: 11:1

University of Minnesota-Crookston

Score: 70.52

- Undergraduate Tuition

- In-State: $13,120

- Out-of-State:$13,120

- Net Price: $13,442

- Acceptance Rate: 58%

- Retention Rate: 77%

- Graduation Rate: 50%

- Total Enrollment: 2,518

- Undergrad Students: 2,518

- Graduate Students: N/A

- Grads Salary: $74,000

- Student-to-faculty: 17:1

Bushnell University

Score: 70.3

- Undergraduate Tuition

- In-State: $34,740

- Out-of-State:$34,740

- Net Price: $22,534

- Acceptance Rate: 66%

- Retention Rate: 71%

- Graduation Rate: 62%

- Total Enrollment: 758

- Undergrad Students: 535

- Graduate Students: 223

- Grads Salary: $78,000

- Student-to-faculty: 15:1

DeSales University

Score: 70.13

- Undergraduate Tuition

- In-State: $44,800

- Out-of-State:$44,800

- Net Price: $30,524

- Acceptance Rate: 79%

- Retention Rate: 81%

- Graduation Rate: 71%

- Total Enrollment: 2,919

- Undergrad Students: 2,149

- Graduate Students: 770

- Grads Salary: $79,000

- Student-to-faculty: 11:1

Indiana Wesleyan University

Score: 70.1

- Undergraduate Tuition

- In-State: $31,168

- Out-of-State:$31,168

- Net Price: $23,364

- Acceptance Rate: 82%

- Retention Rate: 79%

- Graduation Rate: 66%

- Total Enrollment: 2,207

- Undergrad Students: 2,079

- Graduate Students: 128

- Grads Salary: $75,000

- Student-to-faculty: 12:1

University of Louisville

Score: 70.09

- Undergraduate Tuition

- In-State: $12,828

- Out-of-State:$29,174

- Net Price: $18,808

- Acceptance Rate: 81%

- Retention Rate: 81%

- Graduation Rate: 61%

- Total Enrollment: 22,139

- Undergrad Students: 16,194

- Graduate Students: 5,945

- Grads Salary: $73,000

- Student-to-faculty: 14:1

Monroe University

Score: 70.05

- Undergraduate Tuition

- In-State: $17,922

- Out-of-State:$17,922

- Net Price: $11,476

- Acceptance Rate: 66%

- Retention Rate: 70%

- Graduation Rate: 57%

- Total Enrollment: 7,924

- Undergrad Students: 6,400

- Graduate Students: 1,524

- Grads Salary: $69,000

- Student-to-faculty: 18:1

Elizabethtown College

Score: 69.97

- Undergraduate Tuition

- In-State: $36,842

- Out-of-State:$36,842

- Net Price: $27,019

- Acceptance Rate: 77%

- Retention Rate: 84%

- Graduation Rate: 77%

- Total Enrollment: 2,152

- Undergrad Students: 1,857

- Graduate Students: 295

- Grads Salary: $70,000

- Student-to-faculty: 12:1

Friends University

Score: 69.72

- Undergraduate Tuition

- In-State: $32,748

- Out-of-State:$32,748

- Net Price: $22,579

- Acceptance Rate: 56%

- Retention Rate: 70%

- Graduation Rate: 61%

- Total Enrollment: 1,927

- Undergrad Students: 1,460

- Graduate Students: 467

- Grads Salary: $76,000

- Student-to-faculty: 14:1

University of Alabama at Birmingham

Score: 69.64

- Undergraduate Tuition

- In-State: $8,832

- Out-of-State:$21,864

- Net Price: $17,413

- Acceptance Rate: 88%

- Retention Rate: 82%

- Graduation Rate: 63%

- Total Enrollment: 21,160

- Undergrad Students: 12,382

- Graduate Students: 8,778

- Grads Salary: $71,000

- Student-to-faculty: 18:1

Master’s Degree in Accounting

An online master’s degree in accounting is often helpful for professionals who intend to apply for administrative or leadership roles in finance. This degree is also a necessary stepping stone for individuals seeking CPA licensure. Generally, online students can choose between two graduate degrees: Master of Accountancy (MAcc) or Master of Business Administration (MBA) with an accounting concentration. Some accounting majors will also pursue a PhD in Accounting. An MAcc generally centers around coursework designed to prepare online students to take the Uniform CPA Exam, whereas a master of business administration provides a broad curriculum related to business strategy, finance, and client management. Both generally consist of 60 credit hours and take approximately two years to complete. These graduate degree options often prepare advanced accounting graduates for work as an auditor, enrolled agent, corporate budget analyst, cost accountant, controller, tax planner, or financial manager. Every college and university is different, but coursework frequently covers:

Sample Courses

- Financial Decision Making

- Applied Statistics for Business Decisions

- Financial Accounting

- Corporate Financial Reporting

- Financial Statement Analysis

- Auditing and Assurance

- Federal Taxation

- Financial Consultation

- Contemporary Issues in Accounting

- Financial and Managerial Accounting

- Computer-Based Information Systems

- Business Taxation

Best Online Master's Degrees in Accounting Rankings

University of North Carolina at Chapel Hill

Score: 89.97

- Graduate Tuition

- In-State: $10,552

- Out-of-State:$28,844

- Net Price: $11,140

- Acceptance Rate: 19%

- Retention Rate: 97%

- Graduation Rate: 92%

- Total Enrollment: 32,234

- Undergrad Students: 20,681

- Graduate Students: 11,553

- Grads Salary: $77,000

- Student-to-faculty: 15:1

University of Illinois Urbana-Champaign

Score: 87.49

- Graduate Tuition

- In-State: $15,545

- Out-of-State:$30,348

- Net Price: $14,297

- Acceptance Rate: 44%

- Retention Rate: 94%

- Graduation Rate: 85%

- Total Enrollment: 56,563

- Undergrad Students: 35,564

- Graduate Students: 20,999

- Grads Salary: $84,000

- Student-to-faculty: 20:1

North Carolina State University at Raleigh

Score: 87.19

- Graduate Tuition

- In-State: $9,459

- Out-of-State:$29,433

- Net Price: $14,860

- Acceptance Rate: 40%

- Retention Rate: 93%

- Graduation Rate: 85%

- Total Enrollment: 37,323

- Undergrad Students: 27,323

- Graduate Students: 10,000

- Grads Salary: $82,000

- Student-to-faculty: 15:1

University of Connecticut

Score: 83.11

- Graduate Tuition

- In-State: $18,834

- Out-of-State:$40,746

- Net Price: $22,324

- Acceptance Rate: 54%

- Retention Rate: 91%

- Graduation Rate: 84%

- Total Enrollment: 27,364

- Undergrad Students: 19,388

- Graduate Students: 7,976

- Grads Salary: $82,000

- Student-to-faculty: 16:1

University of Massachusetts-Amherst

Score: 82.12

- Graduate Tuition

- In-State: $14,723

- Out-of-State:$32,434

- Net Price: $22,954

- Acceptance Rate: 58%

- Retention Rate: 91%

- Graduation Rate: 83%

- Total Enrollment: 31,810

- Undergrad Students: 23,936

- Graduate Students: 7,874

- Grads Salary: $82,000

- Student-to-faculty: 18:1

Bentley University

Score: 81.5

- Graduate Tuition

- In-State: $44,720

- Out-of-State:$44,720

- Net Price: $43,858

- Acceptance Rate: 48%

- Retention Rate: 93%

- Graduation Rate: 88%

- Total Enrollment: 5,264

- Undergrad Students: 4,350

- Graduate Students: 914

- Grads Salary: $91,000

- Student-to-faculty: 12:1

University of St. Francis

Score: 80.51

- Graduate Tuition

- In-State: $14,382

- Out-of-State:$14,382

- Net Price: $16,455

- Acceptance Rate: 64%

- Retention Rate: 73%

- Graduation Rate: 65%

- Total Enrollment: 3,185

- Undergrad Students: 1,306

- Graduate Students: 1,879

- Grads Salary: $88,000

- Student-to-faculty: 13:1

The University of Texas at Dallas

Score: 79.95

- Graduate Tuition

- In-State: $15,088

- Out-of-State:$29,468

- Net Price: $13,464

- Acceptance Rate: 65%

- Retention Rate: 88%

- Graduation Rate: 71%

- Total Enrollment: 30,885

- Undergrad Students: 21,330

- Graduate Students: 9,555

- Grads Salary: $81,000

- Student-to-faculty: 27:1

Rutgers University-Newark

Score: 78.61

- Graduate Tuition

- In-State: $19,824

- Out-of-State:$33,720

- Net Price: $17,425

- Acceptance Rate: 79%

- Retention Rate: 84%

- Graduation Rate: 68%

- Total Enrollment: 10,809

- Undergrad Students: 7,417

- Graduate Students: 3,392

- Grads Salary: $82,000

- Student-to-faculty: 13:1

Florida International University

Score: 78.6

- Graduate Tuition

- In-State: $9,119

- Out-of-State:$21,600

- Net Price: $10,742

- Acceptance Rate: 59%

- Retention Rate: 92%

- Graduation Rate: 74%

- Total Enrollment: 53,953

- Undergrad Students: 44,363

- Graduate Students: 9,590

- Grads Salary: $71,000

- Student-to-faculty: 24:1

Auburn University

Score: 78.26

- Graduate Tuition

- In-State: $10,692

- Out-of-State:$32,076

- Net Price: $24,524

- Acceptance Rate: 50%

- Retention Rate: 93%

- Graduation Rate: 79%

- Total Enrollment: 33,015

- Undergrad Students: 26,874

- Graduate Students: 6,141

- Grads Salary: $76,000

- Student-to-faculty: 21:1

University of Massachusetts-Lowell

Score: 78.02

- Graduate Tuition

- In-State: $15,330

- Out-of-State:$27,706

- Net Price: $17,624

- Acceptance Rate: 85%

- Retention Rate: 82%

- Graduation Rate: 70%

- Total Enrollment: 16,770

- Undergrad Students: 12,128

- Graduate Students: 4,642

- Grads Salary: $82,000

- Student-to-faculty: 17:1

Assumption University

Score: 77.76

- Graduate Tuition

- In-State: $14,706

- Out-of-State:$14,706

- Net Price: $29,072

- Acceptance Rate: 87%

- Retention Rate: 83%

- Graduation Rate: 75%

- Total Enrollment: 2,046

- Undergrad Students: 1,688

- Graduate Students: 358

- Grads Salary: $86,000

- Student-to-faculty: 11:1

George Mason University

Score: 77.68

- Graduate Tuition

- In-State: $13,726

- Out-of-State:$35,677

- Net Price: $18,900

- Acceptance Rate: 89%

- Retention Rate: 87%

- Graduation Rate: 69%

- Total Enrollment: 39,527

- Undergrad Students: 27,666

- Graduate Students: 11,861

- Grads Salary: $82,000

- Student-to-faculty: 16:1

University of Missouri-Columbia

Score: 76.38

- Graduate Tuition

- In-State: $12,000

- Out-of-State:$30,000

- Net Price: $20,006

- Acceptance Rate: 77%

- Retention Rate: 91%

- Graduation Rate: 76%

- Total Enrollment: 31,013

- Undergrad Students: 23,613

- Graduate Students: 7,400

- Grads Salary: $73,000

- Student-to-faculty: 17:1

University of Arizona

Score: 76.2

- Graduate Tuition

- In-State: $12,718

- Out-of-State:$32,290

- Net Price: $18,144

- Acceptance Rate: 86%

- Retention Rate: 88%

- Graduation Rate: 66%

- Total Enrollment: 53,001

- Undergrad Students: 41,899

- Graduate Students: 11,102

- Grads Salary: $80,000

- Student-to-faculty: 19:1

Regis University

Score: 76.09

- Graduate Tuition

- In-State: $14,573

- Out-of-State:$14,573

- Net Price: $25,062

- Acceptance Rate: 87%

- Retention Rate: 75%

- Graduation Rate: 61%

- Total Enrollment: 4,631

- Undergrad Students: 2,680

- Graduate Students: 1,951

- Grads Salary: $89,000

- Student-to-faculty: 9:1

Maryville University of Saint Louis

Score: 75.39

- Graduate Tuition

- In-State: $14,346

- Out-of-State:$14,346

- Net Price: $26,733

- Acceptance Rate: 94%

- Retention Rate: 83%

- Graduation Rate: 72%

- Total Enrollment: 9,883

- Undergrad Students: 6,062

- Graduate Students: 3,821

- Grads Salary: $82,000

- Student-to-faculty: 13:1

Saint Joseph's College of Maine

Score: 75.27

- Graduate Tuition

- In-State: $9,630

- Out-of-State:$9,630

- Net Price: $28,268

- Acceptance Rate: 82%

- Retention Rate: 80%

- Graduation Rate: 69%

- Total Enrollment: 1,463

- Undergrad Students: 1,059

- Graduate Students: 404

- Grads Salary: $83,000

- Student-to-faculty: 10:1

Kansas State University

Score: 74.97

- Graduate Tuition

- In-State: $10,808

- Out-of-State:$24,169

- Net Price: $18,745

- Acceptance Rate: 79%

- Retention Rate: 87%

- Graduation Rate: 70%

- Total Enrollment: 19,745

- Undergrad Students: 15,113

- Graduate Students: 4,632

- Grads Salary: $74,000

- Student-to-faculty: 18:1

California State University-Sacramento

Score: 74.92

- Graduate Tuition

- In-State: $7,176

- Out-of-State:$16,680

- Net Price: $11,183

- Acceptance Rate: 94%

- Retention Rate: 81%

- Graduation Rate: 56%

- Total Enrollment: 31,172

- Undergrad Students: 28,268

- Graduate Students: 2,904

- Grads Salary: $81,000

- Student-to-faculty: 21:1

SUNY Polytechnic Institute

Score: 74.63

- Graduate Tuition

- In-State: $11,310

- Out-of-State:$23,790

- Net Price: $14,646

- Acceptance Rate: 78%

- Retention Rate: 68%

- Graduation Rate: 59%

- Total Enrollment: 2,704

- Undergrad Students: 1,904

- Graduate Students: 800

- Grads Salary: $80,000

- Student-to-faculty: 14:1

St. John's University

Score: 74.41

- Graduate Tuition

- In-State: $33,386

- Out-of-State:$33,386

- Net Price: $28,206

- Acceptance Rate: 80%

- Retention Rate: 80%

- Graduation Rate: 68%

- Total Enrollment: 19,691

- Undergrad Students: 15,699

- Graduate Students: 3,992

- Grads Salary: $83,000

- Student-to-faculty: 16:1

Colorado State University-Fort Collins

Score: 74.29

- Graduate Tuition

- In-State: $11,159

- Out-of-State:$27,361

- Net Price: $19,828

- Acceptance Rate: 90%

- Retention Rate: 85%

- Graduation Rate: 67%

- Total Enrollment: 33,500

- Undergrad Students: 25,834

- Graduate Students: 7,666

- Grads Salary: $77,000

- Student-to-faculty: 17:1

The University of West Florida

Score: 74.25

- Graduate Tuition

- In-State: $7,088

- Out-of-State:$22,166

- Net Price: $8,908

- Acceptance Rate: 57%

- Retention Rate: 88%

- Graduation Rate: 62%

- Total Enrollment: 14,371

- Undergrad Students: 9,661

- Graduate Students: 4,710

- Grads Salary: $67,000

- Student-to-faculty: 22:1

Best Online MBA Degrees in Accounting Rankings

Carnegie Mellon University

Score: 84.8

- Graduate Tuition

- In-State: $48,496

- Out-of-State:$48,496

- Net Price: $32,964

- Acceptance Rate: 11%

- Retention Rate: 97%

- Graduation Rate: 93%

- Total Enrollment: 15,596

- Undergrad Students: 7,289

- Graduate Students: 8,307

- Grads Salary: $108,000

- Student-to-faculty: 5:1

Georgia Institute of Technology

Score: 83.68

- Graduate Tuition

- In-State: $14,064

- Out-of-State:$29,140

- Net Price: $15,901

- Acceptance Rate: 16%

- Retention Rate: 98%

- Graduation Rate: 92%

- Total Enrollment: 47,946

- Undergrad Students: 19,505

- Graduate Students: 28,441

- Grads Salary: $95,000

- Student-to-faculty: 18:1

University of Pennsylvania

Score: 83.32

- Graduate Tuition

- In-State: $41,544

- Out-of-State:$41,544

- Net Price: $26,017

- Acceptance Rate: 6%

- Retention Rate: 98%

- Graduation Rate: 97%

- Total Enrollment: 28,711

- Undergrad Students: 11,611

- Graduate Students: 17,100

- Grads Salary: $94,000

- Student-to-faculty: 8:1

Vanderbilt University

Score: 80.34

- Graduate Tuition

- In-State: $54,744

- Out-of-State:$54,744

- Net Price: $26,689

- Acceptance Rate: 6%

- Retention Rate: 96%

- Graduation Rate: 93%

- Total Enrollment: 13,456

- Undergrad Students: 7,152

- Graduate Students: 6,304

- Grads Salary: $89,000

- Student-to-faculty: 7:1

University of Chicago

Score: 78.74

- Graduate Tuition

- In-State: $65,145

- Out-of-State:$65,145

- Net Price: $27,979

- Acceptance Rate: 5%

- Retention Rate: 99%

- Graduation Rate: 95%

- Total Enrollment: 18,339

- Undergrad Students: 7,643

- Graduate Students: 10,696

- Grads Salary: $82,000

- Student-to-faculty: 5:1

- Graduate Tuition

- In-State: $7,176

- Out-of-State:$16,680

- Net Price: $16,888

- Acceptance Rate: 30%

- Retention Rate: 95%

- Graduation Rate: 85%

- Total Enrollment: 22,485

- Undergrad Students: 21,559

- Graduate Students: 926

- Grads Salary: $88,000

- Student-to-faculty: 18:1

University of Maryland

Score: 77.2

- Graduate Tuition

- In-State: $16,560

- Out-of-State:$36,100

- Net Price: $15,833

- Acceptance Rate: 45%

- Retention Rate: 96%

- Graduation Rate: 89%

- Total Enrollment: 40,813

- Undergrad Students: 30,608

- Graduate Students: 10,205

- Grads Salary: $83,000

- Student-to-faculty: 18:1

The University of Texas at Austin

Score: 77.09

- Graduate Tuition

- In-State: $12,012

- Out-of-State:$22,954

- Net Price: $18,036

- Acceptance Rate: 29%

- Retention Rate: 96%

- Graduation Rate: 88%

- Total Enrollment: 53,082

- Undergrad Students: 42,444

- Graduate Students: 10,638

- Grads Salary: $83,000

- Student-to-faculty: 18:1

University of California-Davis

Score: 76.82

- Graduate Tuition

- In-State: $12,264

- Out-of-State:$27,366

- Net Price: $17,315

- Acceptance Rate: 42%

- Retention Rate: 93%

- Graduation Rate: 85%

- Total Enrollment: 39,707

- Undergrad Students: 31,797

- Graduate Students: 7,910

- Grads Salary: $88,000

- Student-to-faculty: 21:1

CUNY Bernard M Baruch College

Score: 74.69

- Graduate Tuition

- In-State: $11,090

- Out-of-State:$20,520

- Net Price: $3,989

- Acceptance Rate: 50%

- Retention Rate: 88%

- Graduation Rate: 72%

- Total Enrollment: 19,698

- Undergrad Students: 16,086

- Graduate Students: 3,612

- Grads Salary: $81,000

- Student-to-faculty: 19:1

University of the Potomac-Washington DC

Score: 74.64

- Graduate Tuition

- In-State: $5,400

- Out-of-State:$5,400

- Net Price: $18,780

- Acceptance Rate: 100%

- Retention Rate: 75%

- Graduation Rate: 50%

- Total Enrollment: 593

- Undergrad Students: 266

- Graduate Students: 327

- Grads Salary: $120,000

- Student-to-faculty: 10:1

Rutgers University-New Brunswick

Score: 73.54

- Graduate Tuition

- In-State: $19,824

- Out-of-State:$33,720

- Net Price: $19,052

- Acceptance Rate: 65%

- Retention Rate: 93%

- Graduation Rate: 85%

- Total Enrollment: 50,617

- Undergrad Students: 36,588

- Graduate Students: 14,029

- Grads Salary: $81,000

- Student-to-faculty: 15:1

Stony Brook University

Score: 73.45

- Graduate Tuition

- In-State: $11,310

- Out-of-State:$24,490

- Net Price: $18,601

- Acceptance Rate: 49%

- Retention Rate: 89%

- Graduation Rate: 78%

- Total Enrollment: 25,865

- Undergrad Students: 17,549

- Graduate Students: 8,316

- Grads Salary: $86,000

- Student-to-faculty: 19:1

Ohio State University

Score: 73.25

- Graduate Tuition

- In-State: $12,515

- Out-of-State:$40,245

- Net Price: $19,575

- Acceptance Rate: 51%

- Retention Rate: 94%

- Graduation Rate: 88%

- Total Enrollment: 60,046

- Undergrad Students: 45,728

- Graduate Students: 14,318

- Grads Salary: $77,000

- Student-to-faculty: 18:1

San Diego State University

Score: 72.31

- Graduate Tuition

- In-State: $7,176

- Out-of-State:$16,680

- Net Price: $19,500

- Acceptance Rate: 34%

- Retention Rate: 90%

- Graduation Rate: 78%

- Total Enrollment: 39,241

- Undergrad Students: 34,050

- Graduate Students: 5,191

- Grads Salary: $82,000

- Student-to-faculty: 22:1

The Pennsylvania State University

Score: 71.63

- Graduate Tuition

- In-State: $24,956

- Out-of-State:$43,266

- Net Price: $27,450

- Acceptance Rate: 54%

- Retention Rate: 92%

- Graduation Rate: 86%

- Total Enrollment: 50,399

- Undergrad Students: 42,223

- Graduate Students: 8,176

- Grads Salary: $81,000

- Student-to-faculty: 15:1

San Jose State University

Score: 71.47

- Graduate Tuition

- In-State: $7,176

- Out-of-State:$16,680

- Net Price: $13,833

- Acceptance Rate: 80%

- Retention Rate: 86%

- Graduation Rate: 65%

- Total Enrollment: 36,062

- Undergrad Students: 27,111

- Graduate Students: 8,951

- Grads Salary: $91,000

- Student-to-faculty: 18:1

Bentley University

Score: 71.12

- Graduate Tuition

- In-State: $44,720

- Out-of-State:$44,720

- Net Price: $43,858

- Acceptance Rate: 48%

- Retention Rate: 93%

- Graduation Rate: 88%

- Total Enrollment: 5,264

- Undergrad Students: 4,350

- Graduate Students: 914

- Grads Salary: $91,000

- Student-to-faculty: 12:1

University of California-Riverside

Score: 71.08

- Graduate Tuition

- In-State: $12,264

- Out-of-State:$27,366

- Net Price: $13,533

- Acceptance Rate: 63%

- Retention Rate: 88%

- Graduation Rate: 77%

- Total Enrollment: 26,426

- Undergrad Students: 22,646

- Graduate Students: 3,780

- Grads Salary: $79,000

- Student-to-faculty: 23:1

University of South Florida

Score: 70.77

- Graduate Tuition

- In-State: $8,350

- Out-of-State:$19,048

- Net Price: $11,578

- Acceptance Rate: 41%

- Retention Rate: 91%

- Graduation Rate: 75%

- Total Enrollment: 48,572

- Undergrad Students: 37,269

- Graduate Students: 11,303

- Grads Salary: $73,000

- Student-to-faculty: 22:1

California State University-Fullerton

Score: 70.21

- Graduate Tuition

- In-State: $7,176

- Out-of-State:$16,680

- Net Price: $6,283

- Acceptance Rate: 87%

- Retention Rate: 85%

- Graduation Rate: 69%

- Total Enrollment: 41,962

- Undergrad Students: 37,125

- Graduate Students: 4,837

- Grads Salary: $80,000

- Student-to-faculty: 22:1

University of St. Francis

Score: 69.86

- Graduate Tuition

- In-State: $14,382

- Out-of-State:$14,382

- Net Price: $16,455

- Acceptance Rate: 64%

- Retention Rate: 73%

- Graduation Rate: 65%

- Total Enrollment: 3,185

- Undergrad Students: 1,306

- Graduate Students: 1,879

- Grads Salary: $88,000

- Student-to-faculty: 13:1

The University of Texas at Dallas

Score: 69.57

- Graduate Tuition

- In-State: $15,088

- Out-of-State:$29,468

- Net Price: $13,464

- Acceptance Rate: 65%

- Retention Rate: 88%

- Graduation Rate: 71%

- Total Enrollment: 30,885

- Undergrad Students: 21,330

- Graduate Students: 9,555

- Grads Salary: $81,000

- Student-to-faculty: 27:1

Colorado College

Score: 69.39

- Graduate Tuition

- In-State: $28,900

- Out-of-State:$28,900

- Net Price: $35,281

- Acceptance Rate: 20%

- Retention Rate: 95%

- Graduation Rate: 86%

- Total Enrollment: 2,173

- Undergrad Students: 2,145

- Graduate Students: 28

- Grads Salary: $73,000

- Student-to-faculty: 9:1

University of Tulsa

Score: 69.03

- Graduate Tuition

- In-State: $25,758

- Out-of-State:$25,758

- Net Price: $23,681

- Acceptance Rate: 58%

- Retention Rate: 85%

- Graduation Rate: 73%

- Total Enrollment: 3,559

- Undergrad Students: 2,485

- Graduate Students: 1,074

- Grads Salary: $80,000

- Student-to-faculty: 9:1

What Can I Do with an Accounting Degree?

Accounting degrees & programs are remarkably diverse. While most of us think of accountants as only providing help during tax season, accountants are working hard all year to provide corporate and individuals with audits that help maximize fiscal efficiency. They work with information technology departments to audit those systems, too. This is only the tip of the accounting iceberg.

Accountants also work within the legal establishment. Forensic accountants help uncover money laundering schemes and reveal those who defraud the IRS. They also help businesses reveal embezzlement schemes and they work with attorneys. For instance, in some civil matters, litigants seek to hide assets from creditors or former spouses. Accountants help reveal the funds and ensure a fair and just outcome.

Click here for Best Campus School RankingsBest College Campus Programs in Accounting

Rice University

Score: 93.04

- Undergraduate Tuition

- In-State: $58,128

- Out-of-State:$58,128

- Net Price: $20,587

- Acceptance Rate: 8%

- Retention Rate: 98%

- Graduation Rate: 96%

- Total Enrollment: 8,556

- Undergrad Students: 4,574

- Graduate Students: 3,982

- Grads Salary: $92,000

- Student-to-faculty: 6:1

University of Pennsylvania

Score: 92.19

- Undergraduate Tuition

- In-State: $66,104

- Out-of-State:$66,104

- Net Price: $26,017

- Acceptance Rate: 6%

- Retention Rate: 98%

- Graduation Rate: 97%

- Total Enrollment: 28,711

- Undergrad Students: 11,611

- Graduate Students: 17,100

- Grads Salary: $94,000

- Student-to-faculty: 8:1

Washington and Lee University

Score: 89.51

- Undergraduate Tuition

- In-State: $64,525

- Out-of-State:$64,525

- Net Price: $24,667

- Acceptance Rate: 17%

- Retention Rate: 95%

- Graduation Rate: 95%

- Total Enrollment: 2,277

- Undergrad Students: 1,898

- Graduate Students: 379

- Grads Salary: $90,000

- Student-to-faculty: 8:1

University of Michigan-Ann Arbor

Score: 89.45

- Undergraduate Tuition

- In-State: $17,228

- Out-of-State:$58,072

- Net Price: $19,005

- Acceptance Rate: 18%

- Retention Rate: 98%

- Graduation Rate: 93%

- Total Enrollment: 52,065

- Undergrad Students: 33,730

- Graduate Students: 18,335

- Grads Salary: $88,000

- Student-to-faculty: 11:1

Vanderbilt University

Score: 88.89

- Undergraduate Tuition

- In-State: $63,946

- Out-of-State:$63,946

- Net Price: $26,689

- Acceptance Rate: 6%

- Retention Rate: 96%

- Graduation Rate: 93%

- Total Enrollment: 13,456

- Undergrad Students: 7,152

- Graduate Students: 6,304

- Grads Salary: $89,000

- Student-to-faculty: 7:1

University of Notre Dame

Score: 87.82

- Undergraduate Tuition

- In-State: $62,693

- Out-of-State:$62,693

- Net Price: $29,083

- Acceptance Rate: 12%

- Retention Rate: 98%

- Graduation Rate: 97%

- Total Enrollment: 13,174

- Undergrad Students: 8,968

- Graduate Students: 4,206

- Grads Salary: $87,000

- Student-to-faculty: 9:1

University of Virginia

Score: 87.73

- Undergraduate Tuition

- In-State: $20,986

- Out-of-State:$58,014

- Net Price: $17,831

- Acceptance Rate: 17%

- Retention Rate: 97%

- Graduation Rate: 95%

- Total Enrollment: 25,924

- Undergrad Students: 17,612

- Graduate Students: 8,312

- Grads Salary: $84,000

- Student-to-faculty: 15:1

Washington University in St. Louis

Score: 87.59

- Undergraduate Tuition

- In-State: $62,982

- Out-of-State:$62,982

- Net Price: $22,440

- Acceptance Rate: 12%

- Retention Rate: 96%

- Graduation Rate: 94%

- Total Enrollment: 16,500

- Undergrad Students: 8,267

- Graduate Students: 8,233

- Grads Salary: $83,000

- Student-to-faculty: 7:1

University of California-Irvine

Score: 86.58

- Undergraduate Tuition

- In-State: $14,237

- Out-of-State:$45,014

- Net Price: $14,647

- Acceptance Rate: 26%

- Retention Rate: 94%

- Graduation Rate: 86%

- Total Enrollment: 36,582

- Undergrad Students: 29,503

- Graduate Students: 7,079

- Grads Salary: $88,000

- Student-to-faculty: 18:1

University of Florida

Score: 86.16

- Undergraduate Tuition

- In-State: $6,381

- Out-of-State:$28,659

- Net Price: $11,521

- Acceptance Rate: 24%

- Retention Rate: 97%

- Graduation Rate: 92%

- Total Enrollment: 54,814

- Undergrad Students: 34,924

- Graduate Students: 19,890

- Grads Salary: $79,000

- Student-to-faculty: 16:1

University of North Carolina at Chapel Hill

Score: 85.92

- Undergraduate Tuition

- In-State: $8,989

- Out-of-State:$39,330

- Net Price: $11,140

- Acceptance Rate: 19%

- Retention Rate: 97%

- Graduation Rate: 92%

- Total Enrollment: 32,234

- Undergrad Students: 20,681

- Graduate Students: 11,553

- Grads Salary: $77,000

- Student-to-faculty: 15:1

University of Washington

Score: 85.49

- Undergraduate Tuition

- In-State: $12,643

- Out-of-State:$41,997

- Net Price: $11,023

- Acceptance Rate: 43%

- Retention Rate: 95%

- Graduation Rate: 84%

- Total Enrollment: 55,620

- Undergrad Students: 39,515

- Graduate Students: 16,105

- Grads Salary: $87,000

- Student-to-faculty: 20:1

Emory University

Score: 85.46

- Undergraduate Tuition

- In-State: $60,774

- Out-of-State:$60,774

- Net Price: $27,986

- Acceptance Rate: 11%

- Retention Rate: 96%

- Graduation Rate: 92%

- Total Enrollment: 15,046

- Undergrad Students: 7,359

- Graduate Students: 7,687

- Grads Salary: $84,000

- Student-to-faculty: 9:1

New York University

Score: 85.19

- Undergraduate Tuition

- In-State: $60,438

- Out-of-State:$60,438

- Net Price: $30,730

- Acceptance Rate: 9%

- Retention Rate: 96%

- Graduation Rate: 88%

- Total Enrollment: 57,335

- Undergrad Students: 29,760

- Graduate Students: 27,575

- Grads Salary: $87,000

- Student-to-faculty: 8:1

University of Southern California

Score: 84.93

- Undergraduate Tuition

- In-State: $68,237

- Out-of-State:$68,237

- Net Price: $41,496

- Acceptance Rate: 10%

- Retention Rate: 97%

- Graduation Rate: 92%

- Total Enrollment: 47,147

- Undergrad Students: 21,023

- Graduate Students: 26,124

- Grads Salary: $92,000

- Student-to-faculty: 9:1

Lehigh University

Score: 84.55

- Undergraduate Tuition

- In-State: $62,180

- Out-of-State:$62,180

- Net Price: $33,289

- Acceptance Rate: 29%

- Retention Rate: 93%

- Graduation Rate: 89%

- Total Enrollment: 7,590

- Undergrad Students: 5,811

- Graduate Students: 1,779

- Grads Salary: $91,000

- Student-to-faculty: 10:1

Binghamton University

Score: 84.4

- Undergraduate Tuition

- In-State: $10,363

- Out-of-State:$29,453

- Net Price: $18,860

- Acceptance Rate: 38%

- Retention Rate: 88%

- Graduation Rate: 84%

- Total Enrollment: 18,456

- Undergrad Students: 14,409

- Graduate Students: 4,047

- Grads Salary: $90,000

- Student-to-faculty: 18:1

Villanova University

Score: 84.35

- Undergraduate Tuition

- In-State: $64,701

- Out-of-State:$64,701

- Net Price: $37,946

- Acceptance Rate: 25%

- Retention Rate: 95%

- Graduation Rate: 92%

- Total Enrollment: 10,111

- Undergrad Students: 7,063

- Graduate Students: 3,048

- Grads Salary: $91,000

- Student-to-faculty: 10:1

University of Maryland

Score: 84.11

- Undergraduate Tuition

- In-State: $11,505

- Out-of-State:$40,306

- Net Price: $15,833

- Acceptance Rate: 45%

- Retention Rate: 96%

- Graduation Rate: 89%

- Total Enrollment: 40,813

- Undergrad Students: 30,608

- Graduate Students: 10,205

- Grads Salary: $83,000

- Student-to-faculty: 18:1

The University of Texas at Austin

Score: 84.05

- Undergraduate Tuition

- In-State: $11,678

- Out-of-State:$42,778

- Net Price: $18,036

- Acceptance Rate: 29%

- Retention Rate: 96%

- Graduation Rate: 88%

- Total Enrollment: 53,082

- Undergrad Students: 42,444

- Graduate Students: 10,638

- Grads Salary: $83,000

- Student-to-faculty: 18:1

University of California-Davis

Score: 83.93

- Undergraduate Tuition

- In-State: $15,247

- Out-of-State:$46,024

- Net Price: $17,315

- Acceptance Rate: 42%

- Retention Rate: 93%

- Graduation Rate: 85%

- Total Enrollment: 39,707

- Undergrad Students: 31,797

- Graduate Students: 7,910

- Grads Salary: $88,000

- Student-to-faculty: 21:1

Georgetown University

Score: 83.82

- Undergraduate Tuition

- In-State: $65,081

- Out-of-State:$65,081

- Net Price: $37,967

- Acceptance Rate: 13%

- Retention Rate: 97%

- Graduation Rate: 94%

- Total Enrollment: 20,392

- Undergrad Students: 7,968

- Graduate Students: 12,424

- Grads Salary: $87,000

- Student-to-faculty: 11:1

Purdue University

Score: 83.78

- Undergraduate Tuition

- In-State: $9,992

- Out-of-State:$28,794

- Net Price: $12,421

- Acceptance Rate: 50%

- Retention Rate: 92%

- Graduation Rate: 83%

- Total Enrollment: 52,905

- Undergrad Students: 39,864

- Graduate Students: 13,041

- Grads Salary: $83,000

- Student-to-faculty: 14:1

William & Mary

Score: 83.64

- Undergraduate Tuition

- In-State: $25,040

- Out-of-State:$49,412

- Net Price: $20,422

- Acceptance Rate: 33%

- Retention Rate: 95%

- Graduation Rate: 91%

- Total Enrollment: 9,762

- Undergrad Students: 6,963

- Graduate Students: 2,799

- Grads Salary: $80,000

- Student-to-faculty: 13:1

North Carolina State University at Raleigh

Score: 83.57

- Undergraduate Tuition

- In-State: $8,895

- Out-of-State:$31,767

- Net Price: $14,860

- Acceptance Rate: 40%

- Retention Rate: 93%

- Graduation Rate: 85%

- Total Enrollment: 37,323

- Undergrad Students: 27,323

- Graduate Students: 10,000

- Grads Salary: $82,000

- Student-to-faculty: 15:1

Fields of Study and Specialization

- Forensic Accounting:

This field focuses on uncovering financial wrongdoing. Not only do forensic accountants become adept at balancing the books and auditing, but they also are versed in the laws that might apply to financial bad guys. Topics can include offshore tax havens, money laundering, and embezzlement. - Managerial Accounting:

This form of accounting is aimed at helping a firm streamline or otherwise improve its operations. The rules governing a managerial accountant will vary according to the needs of each individual firm and the results of their audit will only be shared among other managers or employees. - Tax Accounting:

This is the domain in which we most often place accountants. Tax accountants assess a firm's finances and complete the tax return documents. However, only a certified public accountant (CPA) with an active license from the state may sign off on tax return documentation. - Finance:

This is where accounting and business most often meet. Accountants will be trained to both prepare and analyze financial documents for use in public documentation. - Non-Profit or Government Accounting:

This is a specialty area that is governed by special rules and laws. That is, these organizations needn't worry about taxation, as do for-profit companies, but they must also adhere to special rules. - Accounting Information Technology:

This is a relatively new addition to the accounting world. Since accountants are detail-minded, they are perfect for conducting audits of computer databases, network logs, and more.

Potential Careers and Salaries for Graduates

According to the Bureau of Labor and Statistics (BLS), the median annual wage for most accountant and auditor positions in 2024 was $81,680 per year. The average hourly wage was $39.27. This is well above the national average wage index of $48,642, as reported by the Social Security Administration in 2016.

The outlook for accountants working in the United States is also promising. In fact, the BLS projects that there will be a 10% increase in job availability in this field between 2016 and 2026. When compared to other professions, this is a faster increase than the national average. The major reasons for this growth are likely globalization, an ever-changing economy, and complicated tax regulations.

Career Options

- Auditor:

These professionals analyze a business’ financial and other documents to find areas that could use improvement. Auditors may also work for the Internal Revenue Service and scrutinize tax return documents from individuals or corporations who may be suspected of committing some form of tax fraud or evasion. - Consultant:

Accountants may work for a business in their accounting department but they may also work independently. Independent accountants may consult with businesses who aren't large enough to have their own accounting department. Their function may be to provide assistance with tax returns or to perform an independent audit of the business. - Forensic Accountant:

These accounting professionals work in the legal realm to help uncover financial wrongdoing. They seek out tax evaders, money launderers, embezzlement schemes, and even errant spouses who seek to hide assets during a divorce. - Tax Accountant:

To be a tax accountant, it's ideal to be a licensed certified public accountant (CPA). These professionals analyze their employer's or client's financial documents and prepare their tax returns. Accountants with CPA credentials are legally able to sign off on those returns. - Managerial Accountant:

This is a growing field in accountancy. These professionals apply specific criteria when they audit systems for their employer or client. These audits are not for external use but are intended to help management address specific issues. For instance, the audit might review payroll, benefits, or inventories. - Financial Analyst:

Analysts work for a variety of businesses. Some work for banks to help determine whether a business is worthy of a loan and others work for investment banks to analyze comparable companies for the purposes of corporate valuation.

Search Programs Offering Accounting Majors

Important Questions to Ask (FAQ)

Individuals interested in becoming an accountant or CPA must ask themselves a series of important questions. These include:

How long does it take to earn?

A traditional bachelor’s degree in accounting, sought by taking courses on-campus, generally takes four years to complete. Online accounting degree programs are comparable. As long as students are enrolled full-time, a 120 credit hour online accounting degrees program can usually be completed in an average of four years. Individuals pursuing an online bachelor of science in accounting degree on a part-time basis, however, should expect it to take longer. In most cases, these students will graduate in five to eight years.

How much does it cost?

The cost of an online bachelor's in accounting degree varies significantly between institutions. According to the College Board’s Trends in Higher Education Series, the average in-state tuition for a four-year, public education was $11,610 in 2024-25. Students who enrolled at a four-year, private college or university paid an average tuition of $41,540 in 2024-25. Of course, these totals increase significantly when fees, room, and board are included.

What does the coursework look like for online classes?

Course titles will vary significantly, but the coursework for an accounting bachelor’s degree online often includes topics such as:

- Principles of Accounting

- Contemporary Business Law

- Federal Taxes

- Microeconomics

- Business Communication

- Financial Statement Auditing

- Accounting Theory and Research

- Payroll Accounting

- Fraud Examination

- Internal Controls and Risk Assessment

- Computer Applications and Systems

- Managerial Accounting

- Internal Reporting Issues

- Attestation and Assurance

- Accounting Information Systems

Does the school have the major(s) you are considering?

Another important consideration is the list of majors the college or university offers. While many institutions have online accounting programs, not all of them do. Some schools offer an online business degree instead, but provide students the opportunity to select an accounting concentration. In most cases, graduate accounting program boards consider this sufficient prior experience in the field. Additionally, the majority of state accountancy boards accept both accounting and business degrees as long as the completed coursework aligns with their CPA content requirements.

How many students graduate “on time,” or within four years?

Before selecting a college or university, students should also inquire about the typical graduation rate and timeframe. Often, this information can be found on institution websites. Alternatively, speaking directly with the accounting program can offer great insight on this matter. The department will have specific information regarding average time of completion, graduation rates, employment success, and starting salaries.

What kind of accreditation does the online program hold? How it is regarded in the field?

Accreditation is another factor. Every college and university has the opportunity to have their online accounting program accredited by an international or regional accreditation agency. This process confirms that an institution and its offered coursework adhere to specific, standard guidelines within a particular field. The most prominent international accreditation organizations are:

- Association to Advance Collegiate Schools of Business (AACSB)

- The Association of MBAs (AMBA)

- European Quality Improvement System (EQUIS)

- The Distance Education and Training Council (DETC)

Of these, the AACSB is, by far, the most prestigious. This agency’s accreditation standards are high, but institutions that opt to undergo the rigorous accreditation process offer some of the best online accounting programs available. Individuals seeking an online accounting degree should give colleges and university accredited by the DETC preference, as the AACSB rarely accredits distance-learning or online programs, whether they offer a bachelor's or master's for an accounting degree online.

Alternatively, students can consider institutions accredited by a regional accrediting agency. These organizations ensure that accounting programs meet the standards of a particular area. Those who intend to remain relatively local after graduation should have the knowledge and skills necessary to work professionally within the accreditation region. Regional accrediting agencies include:

- Middle States Commission on Higher Education (MSCHE)

- New England Association of Schools and Colleges (NEASC)

- North Central Association Commission on Accreditation and School Improvement (NCACS)

- Northwest Commission on Colleges and Universities (NWCCU)

- Southern Association of Colleges and Schools Commission on Colleges (SACS COC)

- Western Association of Schools and Colleges Accrediting Commission for Schools (WASC ACS)

Scholarships for Financial Aid

There are many financial aid assistance opportunities for individuals interested in pursuing an undergraduate associates or graduate accounting degree online. The money to fund these financial aid scholarships and grants is generally provided by professional associations, civic groups, government agencies, non-profit agencies, and major corporations with ties to the communities where college degrees are offered. Some of the most prominent national financial aid accounting scholarships include:

- John L. Carey Scholarship via the American Institute of CPAs

- Accountemps Student Scholarship via the American Institute of CPAs

- Scholarship for Minority Accounting Students via the American Institute of CPAs

- Newton B. Becker Scholarship via Becker Professional Education

- Public Company Accounting Oversight Board Scholarship Program

- National Society of Accountants Scholarship Foundation

- Daniel B. Goldberg Scholarship via the Government Finance Officers Association

Many states also offer scholarships for students who intend to major in accounting. This should be a consideration when looking for and applying to college and university online accounting programs.

Every scholarship is different, but all of them have application requirements. Before receiving aid, students must be able to prove they are eligible. Candidates should thoroughly research scholarship expectations before applying. Some of the most common requirements include:

- Future or current enrollment in an accounting degree program

- Intention to pursue CPA licensure